What effect would sovereign default of a European country have on personal debt, especially a mortgage?

3 Answers

Patrick,

This article points out three likely effects (direct and indirect) sovereign default can have on the individual:

- capital flight and currency collapse. Inflation jumps, standard of living drops.

- international financial system closes the door. The country must pay penal rates to get their hands on money.

- businesses and individuals must look to foreign sources for loans.

http://tutor2u.net/blog/index.php/economics/comments/the-sovereign-default-option-is-costly/

This looks at how a default may not look like a default - even if it is. But again, how defaults can impact the man in the street:

- taxes increase

- inflation increases

- poor job situation stays poor longer. Poor housing market stays poor longer.

http://online.wsj.com/article/SB10001424052748703323704574602030789251824.html

The fascinating Argentine default is described in a blow-by-blow format here, including brief references to things like unemployment and personal savings:

- foreign investment stops

- run on banks

- massive inflation spike

- currency-of-savings converted (!)

- currency value crashes

- development of "alternative" and "informal" economic frameworks (e.g., barter networks)

- unemployment spikes

- tourism, agriculture (exports) crash

Remember, though. Not all defaults are the same. And a modern-European country's default may look very different to what has occurred elsewhere.

- 6,981

- 1

- 28

- 40

This is a hard question to answer. Government debt and mortgages are loosely related. Banks typically use yields on government bonds to determine mortgage interest rates. The banks must be able to get higher rates from the mortgage otherwise they would buy government bonds.

Your question mentions default so I'm assuming a country has reneged on its promise to pay either the principal or interest on government bonds.

The main thing to consider is "Who does not get their money?". In other words, who does the government decide not to pay. This is the important part. The government will have some money so they could pay some bond holders. They must decide who to shaft.

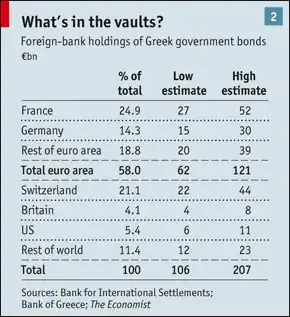

For example, let's look at who holds Greek government debt. Around 70% of Greek government debt is held outside Greece. See table below.

The Greek government could decide to default only on the debt to foreign holders. In that case the banks in France and Switzerland would take the loss on their bonds. This could cause severe problems in France and Switzerland depending on the percentage of Greek bonds that make up the banks' assets. Greek banks would still face losses, however, since the price of their Greek bond holdings would drop sharply when the government defaults. Interestingly, the losses for the Greek banks may be smaller than the losses faced by the French and Swiss banks. This is usually the favored option chosen by government since the French and Swiss don't vote in Greece.

Yields on Greek government bonds would rise dramatically. If your Greek mortgage is an adjustable rate mortgage then you could see some big adjustments upward. If you live in France or Switzerland then the bank that owns your mortgage may go under if Greece defaults. During liquidation the bank will sell their assets which includes mortgages and you will probably not notice any difference in your mortgage.

As I stated earlier: this is a hard question to answer since the two financial instruments involved (bonds and mortgages) are similar but may or may not be related.

If the default happens through mass monetary inflation rather than openly ("We're not paying interest on our bonds") then make sure you pay off your house. There may not be a very long window to do so.

If the currency becomes worthless, then it depends on what you have of value that would be accepted by the lender as payment. If you don't have anything, the lender will take it back, as they're probably entitled to on the notes.

- 24,840

- 2

- 50

- 88