https://www.irs.gov/publications/p969/ar02.html#en_US_2014_publink1000204045

I currently have an individual HDHP. I am trying to understand the implications on my HSA contribution limit for 2016 if I add my wife to my policy.

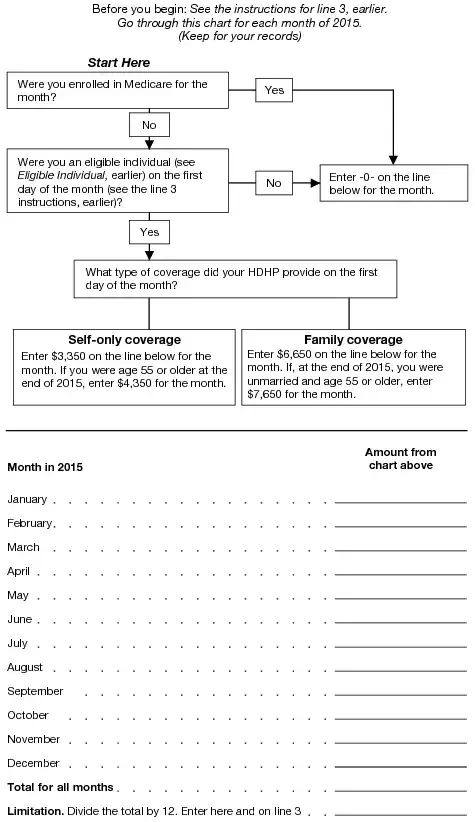

It looks like the Line 3 Limitation Chart and Worksheet flowchart thing here suggests that you can basically average your yearly contribution amount, based on the number of months you were on each plan:

The reason it's confusing is that the main 969 publication has a lot of references on your status on Dec 1st of the year, allowing you to potentially contribute the entire amount for the year.. sort of.