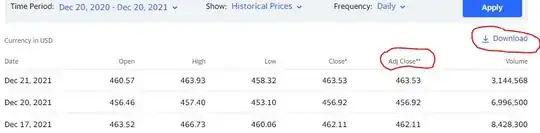

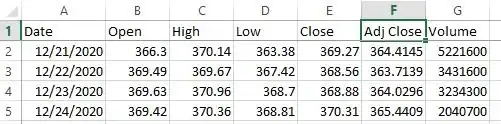

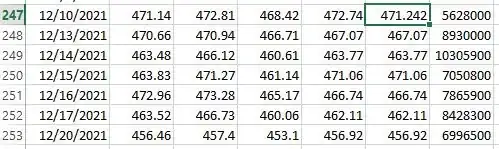

I have read the questions and answers about historical data from sites like Google and Yahoo! Finance (which has been dis-improved, imo, in 2016.) My question is this: Exactly how are closing price data-points adjusted for dividends? What is the relationship between ex-div and pay date or dividends with respect to the adjustments these sites are making? If a historical price-point is adjusted for dividends does that mean that if a company pays 12 times per year, that the historical prices that are 13 months old have been adjusted for the 12 dividends that have happened since then? If one wants info about a stock from one point in time to another point in time without assuming the stock is still held, are these historical quotes "valid" at all?

"Back in the day" one used to be able to go to the library and look up the stock quotes for End of Day from a newspaper in the Reference section of the library and get the Actual Close Price, not adjusted for anything and when you went back 3 years later, the newspaper from that day would still have the same information on that date. These adjusted price-points may be useful for prospective investors, but they don't seem to be historical. I also find that these adjusted quotes are reported through sites like NASDAQ.com, which would seem to be a site with access to data that is closer to the source than Yahoo! or Google.