Most plans yes, but it depends on your specific plan's provisions.

You want to get a Summary Plan Description for your specific plan. Speak with HR (assuming you have one, or whoever is in charge at your company) and request a Summary Plan Description (they are legally required to provide you with one if you ask, although there may be a small cost to you for printing). It will tell you in there when distributions may be made following severance of employment as it pertains to your specific plan.

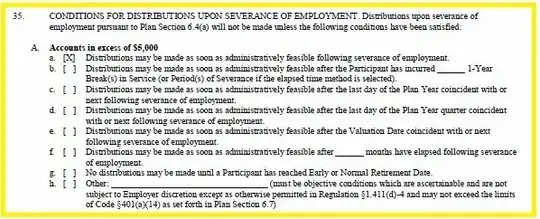

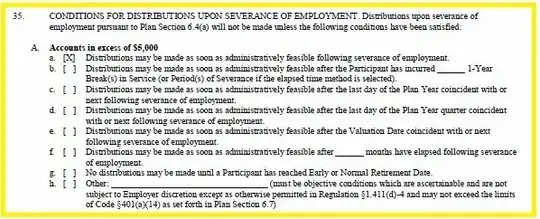

An excerpt from the doc submitted to the IRS for plan approval -

option g would be the choice that's available, and participant should watch out for.

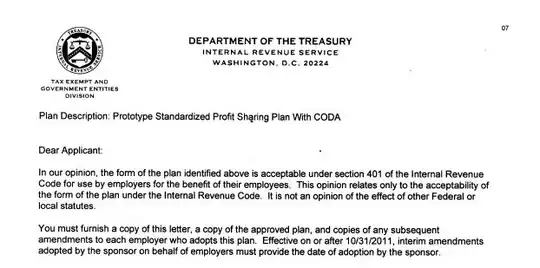

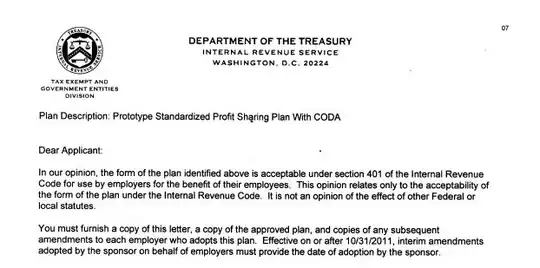

This is the response (a small excerpt, the full doc ran 2 pages and had private information) -

It confirms the full document (the plan itself) was approved.