Why? Simply: because it has been mandated as law, and so you may have no choice in the matter whether to contribute or not. Quoting from GOV.UK – Workplace pensions:

‘Automatic enrolment’

A new law means that every employer must automatically enrol workers

into a workplace pension scheme if they:

- are aged between 22 and State Pension age

- earn more than £10,000 a year

- work in the UK

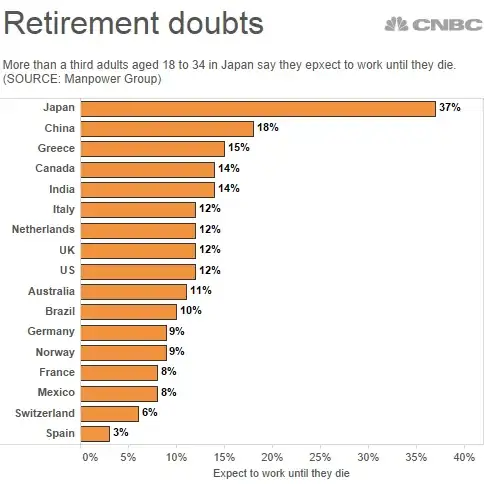

Next: even if you think you will work "until you die", you can still access the money saved in the pension scheme when you attain the required minimum age for withdrawals under your scheme. For instance, that may be age 55, but it may also vary by scheme.

Becoming fully retired — as in stopping all work — is not a requirement to access retirement income from your pension scheme. In the eyes of a pension scheme, retirement is typically when you elect to take your income benefits according to the established rules of the scheme. Quoting from nidirect – Working past State Pension age:

Continuing in work and your workplace pension

If you reached the age at which you can start claiming your workplace

pension scheme, you don't need to stop work in order to claim. You have

a number of options, including taking some of the pension you've built

up while continuing to work for the same employer.

As to why things are set up this way: While some younger folk may, today, expect to continue working until death, for a variety of reasons that isn't always possible. Two typical such reasons are: disability, and involuntary unemployment (i.e. willing and able but still can't land the next job). Moreover, plans change. Young workers with health and vitality may expect they'll always feel invincible, but end up learning otherwise over time, and may come to appreciate the savings that were forced upon them.

The "forced savings" aspect of state and state-sponsored pension schemes are meant to provide some safety net for those later years when it is a strong possibility that one can't continue to work. The alternative is to be a 100% burden on family and/or society.