If you would've copied to sentence before this sentence, it would be quite obvious:

UltimateAccount annual percentage yield (APY) is 5.00% on balances up to $5,000. Balances above $5,000 earn a simple interest rate of 0.1 %.

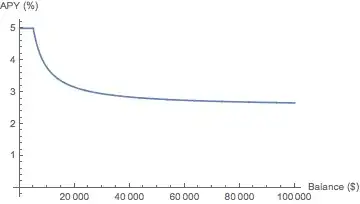

So if your total is below 5000, you get 5%. Above 5000 you get 0.1%. Depending on your total, the average is between 5% and 0.1%; the more you have, the lower.

If you put 10000 in the account, the first 5000 give 5%, and the remaining 5000 give 0.1%, which adds to 5000*5%+5000*.1% = 250+5 = 255 = 2.55% of 10000 (The small difference to 2.54 is either rounding error, or comes from them only giving interest for 360 days instead of 365 per year (which is usual), and the APR is defined by law to reflect the annual effective rate.

If you put any number between 5000 and 10000 in the account, the summary APR lies between 5% and 2.55%. For example 6000 gives: 5000*5%+1000*.1% = 250 + 1 = 251; 251 of 6000 is 4.183%. If you use 7000, you get 5000*5%+2000*.1% = 250 + 2 = 252; 252 of 7000 is 3.6%. You should be able to repeat this math for any other number.

Each number between 5000 and 10000 gives an overall APR between 5% and 2.55%; the larger the input, the lower the average APR.

Note that that implies that either they assume nobody would put more than 10000 in such an account; or they assume this limit for cosmetic reasons (otherwise it would read '0.1 - 5%' APR, much uglier...); or the fine print states that there is no interest after 10000 at all.