I know that for interest rates you calculate the monthly rate by dividing by 12 (or similarly for any period by the number of periods/year). But if I have a 3 month CD that has a 0.4% APY, does that mean that I'll see 0.1% (or 0.4*0.25) for the 3 month period?

2 Answers

To clarify. APY will always be an annual number. To calculate your APY you use the formulas below with your APR, the applicable compounding frequency, and duration of an entire year. The more frequent the compounding occurs the greater your yield relative to your rate. When you have a maturity period less than a year, the APY is still calculated based on holding for a full year.

Assuming a 0.4% APR, you will receive 0.4% for the duration of the CD. Generally bank CDs are compounded daily which will help out a bit. You can roughly calculate your return by (assuming a $1,000 deposit and a 3 month duration):

Monthly Compounding: 1000 * ( 1 + .004/12 ) ^ 3

Daily Compounding: 1000 * ( 1 + .004/360 ) ^ 90

On such a short time frame the effects of compounding will be negligible. And the published APY can be largely ignored as you will not be holding the CD for a year, unless you buy another three month CD at the same rate after maturity.

- 49,074

- 11

- 101

- 161

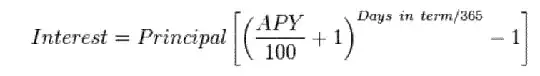

According to this Wikipedia article, https://en.wikipedia.org/wiki/Annual_percentage_yield, the Federally defined meaning of APY produces this formula:

Assuming a 91-day period for the three month period, we get $0.9957665 on a $1000 CD

- 4,294

- 2

- 16

- 19