There are two scenarios to determine the relevant date, and then a couple of options to determine the relevant price.

Relevant Date

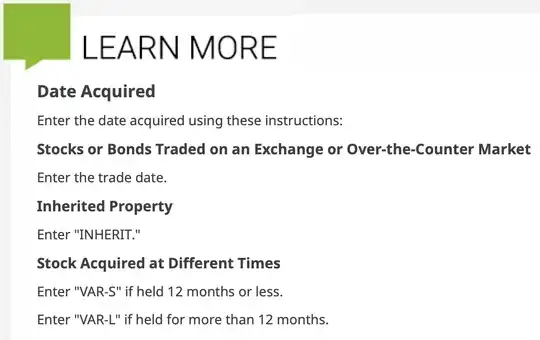

If the stocks were purchased in your name from the start - then the relevant date is the date of the purchase.

If the stocks were willed to you (i.e.: you inherited them), then the relevant date is the date at which the person who willed them to you had died.

How to figure out

You can check with the company if they have records of the original purchase. If it was in "street name" - they may not have such records, and then you need to figure out what broker it was to hold them.

Figuring the price

Once you figured out the relevant date, contact the company's "investor relationships" contact and ask them for the adjusted stock price on that date (adjusted for splits/mergers/acquisitions/whatever). That would be the cost basis per share you would be using.

Alternatively you can research historical prices on your favorite financial information site (Google/Yahoo/Bloomberg or the stock exchange where the company is listed).

Last Resort

If you cannot figure the cost basis, or it costs too much - you can just write cost basis as $0, and claim the whole proceeds as gains. You'll pay capital gains tax on the whole amount, but that may end up being cheaper than conducting the investigation to reveal the actual numbers.