I currently have a 75% credit utilization, which I know is not favorable on about 35,000 revolving credit. I am getting my year end bonus and plan on using that to completely pay off all of my credit cards leaving me with a 0% credit utilization. Currently my credit score is 668, mostly due to my utilization, I pay everything on time, but just have too much debt, which is why i'm paying it all off. My question is how much will paying off all my revolving credit and having a 0% utilization on 35,000 credit availability positively effect my credit score?

2 Answers

I wrote an article about FICO scoring which shows that 30% of your score is based on utilization or amount owed. I can't say exactly how much your score will rise, or how long it will take, but your score will improve dramatically from what you propose.

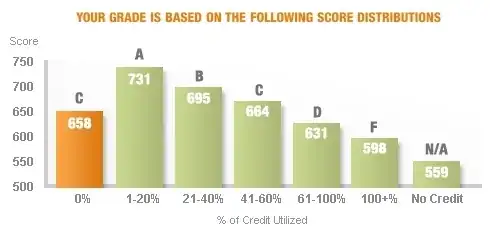

This chart is from Credit Karma, and it shows how zero utilization is actually bad when it comes to your score. I wrote an article on my blog titled Too Little Debt in which I discuss further.

Under 20% is ideal, just not zero.

- 172,694

- 34

- 299

- 561

You really don't know how credit scoring works.

Let's think about the purpose of a credit score: to assess whether you're a high default risk. A lender wants to know, in this order:

- Do you pay your debts? If so, do you pay late?

- How long your behavior be measured?

- Are you solvent?

Utilization factors into the solvency assessment. If you are at 100% utilization of your unsecured credit, you're insolvent -- you can't pay your bills. If you are at 0%, you're as solvent as you can be. Most people who use credit cards are somewhere in the middle.

When a bank underwrites a large loan like a mortgage or car loan, they use your credit score an application information like income and employment history to figure out what kind of loan you qualify for.

Credit cards are called "revolving" accounts for a reason -- you're supposed to use them to buy crap and pay your bill in full at the end of the month.

My advice to you:

- Identify the person who told you that you need to carry credit card debt to have good credit and never, ever listen to them about business matters ever again.

- Pay off all of your cards.

- Use your credit cards as you see fit, as long as you can pay them off in 30 days without paying interest.

- 30,455

- 54

- 101