This question is a follow up question to this " Is my "retire young" strategy a sensible one? "

I am attempting to structure a early retirement strategy. It involves dumping into a 401k (already in progress). Buying rental properties (already in progress) and most recently, building an ETF and mutual fund portfolio (just started this year).

The ETF and Mutual fund plan is as follows:

Purchase $5,000 of each of the following in lump sums, then let sit until I deem them mature.

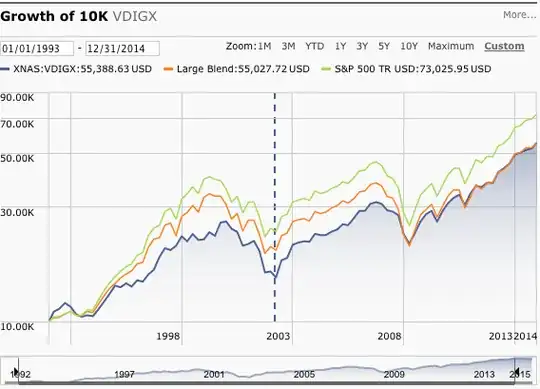

- High Dividend mutual fund that auto reinvests in itself - VDIGX (Expenses .32)

- High growth ETF - VONG (Expenses .12)

(Three more ETFS or Mutual funds that haven't been chosen yet but will not focus in the same sectors as those above. I know I want an industrials focused one and also a healthcare focused one.)

My questions are:

For a young person (29) who is attempting to build a retire early nest egg, does it make sense to use mutual funds and ETFs as the vehicle or is there specific reasons why I shouldn't?

Does the fact that they are managed outweigh the fact that I wouldn't pay expenses if I managed my own?

My assertion is that at very least, I am saving by letting the managers of the funds trade for me so I don't get the trade fees from my bank. Is this on point?