Operating a Ponzi scheme is a crime which I suppose has some sort of definition in the penal code or criminal law. It is a fraudulent investment operation that pays returns to separate investors from their own money or money paid by subsequent investors, rather than from any actual profit earned.

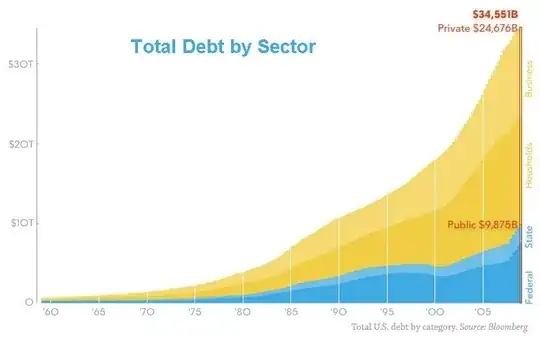

To my understanding this perfectly matches how fractional-reserve banking (involving fiat money) works. Since debt and the interest on the debt can only be paid in the same form of money, the total debt (principal plus interest) can never be paid in a debt-based monetary system unless more money is created through the same process. For example: if 100 credits are created and loaned into the economy at 10% per year, at the end of the year 110 credits will be needed to pay the loan and extinguish the debt. However, since the additional 10 credits does not yet exist, it too must be borrowed. This implies that debt must grow exponentially in order for the monetary system to remain solvent.

However, exponential growth can only be maintained over a finite period of time. Just in case of Ponzi schemes, during this time the scam works and investors are paid in full to attract future investors. Everyone believes therefore that the scheme works. But when the exponential growth slows down, the pyramid collapses. Mostly this happens quite quickly because the initial interest was high. Bernard Madoff's Ponzi scheme has shown that choosing a lower interest rate prolongs the time the scam works. Banks indeed work with even lower interest rates. (There could possibly be an equation showing how long a Ponzi scheme can operate depending on the promised interest.)

I do have basic understanding of economics and I'm not a paranoid capitalism hater. I just do not understand why the fractional-reserve banking could be possibly maintained indefinitely. Then why is it allowed for financial institutions to operate in such manner?