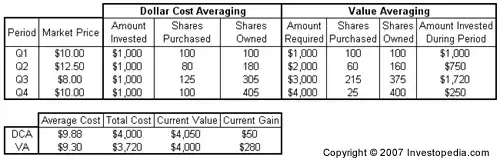

As opposed to dollar cost averaging (DCA), value averaging (as described in this eHow article) is a technique where the investor determines the value the investment should have after a given time frame (monthly or quarterly). The actual performance of the investment then determines how much needs to be bought or sold to achieve the pre-determined value.

This Investopedia article explains the below value averaging example, where the required (aka desired) value is always $1000 more than the previous quarter. My question is how do you determine what the desired/required value should be especially for a retirement account where the desired amount is 30 years away and even then hard to determine? Can you use a desired rate of return (eg. 9%) plus the amount you can afford to contribute each quarter?