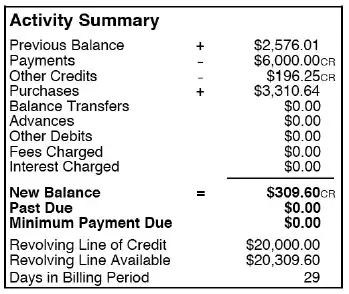

Hypothetically, if kept overpaying a credit card such that the negative balance kept increasing to absurd amounts, what would happen?

For example, say I have a credit card with a line of $500. When making a payment, I accidentally include an extra 0, and so, I end up with a negative balance of $10,000 (that is, I overpaid my credit card by $10,000).

Does that money sit forever as credit, or would the credit servicer eventually notify me and/or send me a check for the negative?

Is there an amount where the credit servicer gets a flag / notification, or I simply can't keep paying more to the card?