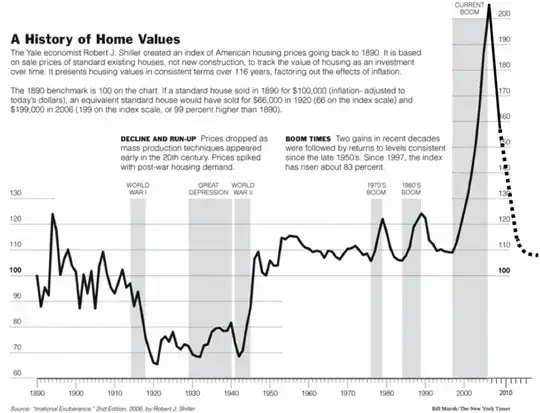

The eminently useful New York Times Buy or Rent calculator assumes a 3% average annual rise in home prices. Curious whether that value made sense, I did some research and came across the views of Robert Shiller, creator of the Case-Shiller index for real estate. He apparently argues that home prices tend to return to their 1890 prices.

Is there some credence to the belief that real estate prices tend to rise over the long term? Or, is this really just a widespread myth, as Shiller argues?

Obviously this greatly effects personal finance calculations because the rate of growth in housing prices is one of the main factors effecting the buy or rent decision, from a purely financial perspective.