It seems as if anyone that's getting paid $398,351 – $400,000 would simply lower their salary to the $183,251 – $398,350 tax bracket and get 2% lower income taxes. Does the bracket serve any purpose, or is it simply some type of bureaucratic necessity?

2 Answers

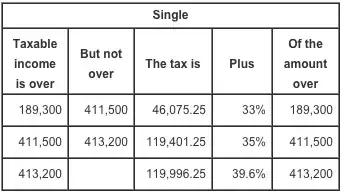

I recognize the numbers you show to reflect the 2013 tax brackets. In 2015 the top of the chart for singles looks like:

Before this remarkably cute little tax bracket appeared, the top rate was 35%. Instead of simply eliminating it, for singles, congress started the next bracket, 39.6% at $413K.

The brackets for married filing joint look a bit saner, with 35% running from $411K-$465K.

- 172,694

- 34

- 299

- 561

Eagle,

It may not be clear yet, but the tax rate in a certain bracket is only applied to the income within that range.

For example, let's say you earn 40k a year. And there are two tax rates which concern you: 10% - on earnings up to 25,000 15% - 25,001-50,000

According to this scheme, you would pay 10% on the first 25k (2,500) and then you would pay 15% on the remainder (c. 2,250). The remainder which incurs the 15% tax rate is your salary, 40k, less the bottom end of the highest bracket, in this case, 25,001.

I hope I did my math right there...

- 41

- 1