There are a number of free online portfolio trackers that offer various features such as analyzing one's portfolio in terms of risk, making suggestions for individual assets, and so forth. It is common for persons to compare their portfolio to the S&P500.

But are there any portfolio trackers that allow one to compare their performance to other users? So that I could see how my portfolio did, on a percentile basis, to other users' portfolios?

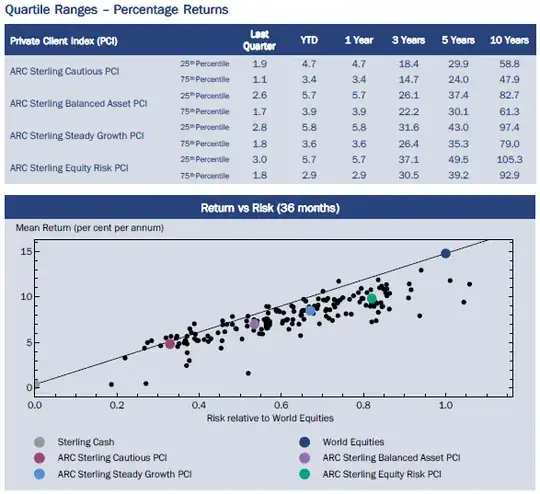

Edit: to provide more clarification based on the responses, risk is important, and could be taken into account to compare portfolios. Also, I recognize that time periods are important, a one-year comparison might not mean much, but comparing 2 well-diversified portfolios over a 3 year or longer period would have more meaning.

There are uses for this beyond curiosity. If one consistently has a higher performance than a large number of others (not friends, using percentiles) over time, then one can have confidence in the portfolio. Similarly, if one is consistently lagging for the same level of risk, then that person is not doing well. Otherwise it is difficult to get any feedback on one's portfolio other than comparing to a benchmark such as the S&P500, but how many people actually have 100% allocation to the S&P500 and are buy and hold investors? How do real life buy and hold investors do compared to market timers? Secondly, being able to view other's real (not theoretical) portfolios is a source of ideas of what to invest in. I am a buy and hold investor and have no problem with posting my portfolio and percentage allocations, but I am not interested in doing this for subjective feedback or there to be any focus on my portfolio, because comparisons need to be done in the context of real data and I would not suggest that my portfolio is better than someone else's, just different, not only due to risk tolerance but also one's beliefs, knowledge, etc.