As a new graduate, aside from the fact that you seem to have the extra $193/mo to pay more towards your loan, we don't know anything else.

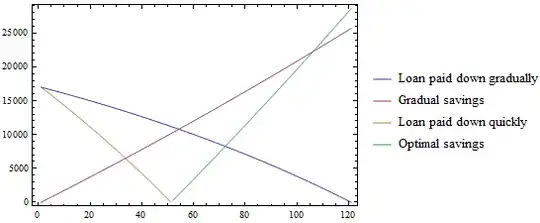

I wrote a lengthy article on this in response to a friend who had a loan, but was also pondering a home purchase in the future. Student Loans and Your First Mortgage discusses the math behind one's ability to put a downpayment on a house vs having that monthly cash to pay towards the mortgage. In your case, the question is whether, in 5 years, the $8500 would be best spent as a home down payment or to pay off the 6.8% loan.

If you specifically had plans toward home ownership, the timing of that plan would affect my answer here, as I discuss in the article.

The right answer to your question can only come by knowing far more of your personal situation.

- Does your employer offer a matched 401(k) (or other matched retirement account if you are not in the US), and are you depositing the full amount to capture that match? It makes little sense to set aside funds to pay off a 6.8% loan if you are leaving a 50 or 100% match on the table.

- Do you have any other high interest debt? 18% card takes priority over this loan.

- What is the nature of your current savings and rate of savings? An emergency fund or funds that would take care of unexpected expenses, including bridging the gap during a time of unemployment is an important first step for the new grad. Start by hitting the first $1000, $2000, etc. But ultimately, you want X months worth of expenses to have a true safety net.

Meanwhile, the plan comes at a cost. Your plan will get rid of the loan in about 5 years, but if you simply double up the payments, advising the servicing company to apply the extra to principal, it would drop to just a couple month over over 4. As you read more about personal finance, you'll find a lot of different views. Some people are fixated on having zero debt, others will focus on liquidity. In the end, you need to understand each approach and decide what's right for you.