This is Ellie Lan, investment analyst at Betterment. To answer your question, American investors are drawn to use the S&P 500 (SPY) as a benchmark to measure the performance of Betterment portfolios, particularly because it’s familiar and it’s the index always reported in the news. However, going all in to invest in SPY is not a good investment strategy—and even using it to compare your own diversified investments is misleading. We outline some of the pitfalls of this approach in this article: Why the S&P 500 Is a Bad Benchmark.

An “algo-advisor” service like Betterment is a preferable approach and provides a number of advantages over simply investing in ETFs (SPY or others like VOO or IVV) that track the S&P 500.

So, why invest with Betterment rather than in the S&P 500?

- Superior risk-adjusted diversification

- Smarter investment management Services

- Better tax management features

Let’s first look at the issue of diversification. SPY only exposes investors to stocks in the U.S. large cap market. This may feel acceptable because of home bias, which is the tendency to invest disproportionately in domestic equities relative to foreign equities, regardless of their home country.

However, investing in one geography and one asset class is riskier than global diversification because inflation risk, exchange-rate risk, and interest-rate risk will likely affect all U.S. stocks to a similar degree in the event of a U.S. downturn.

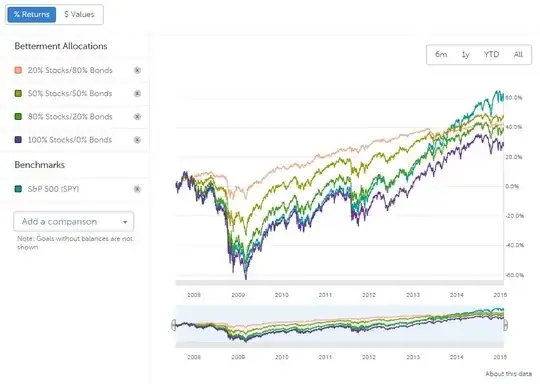

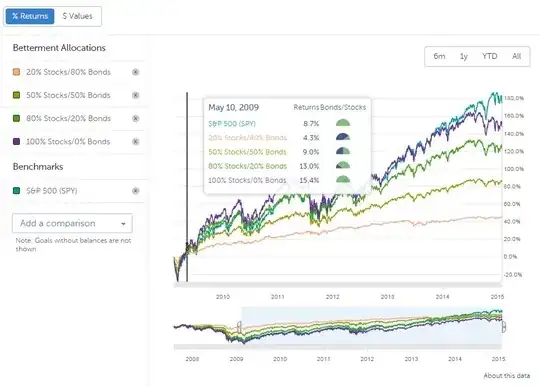

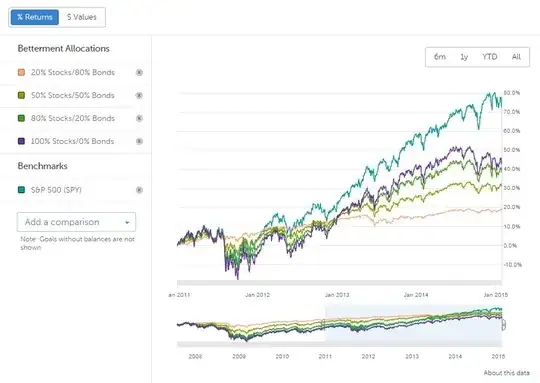

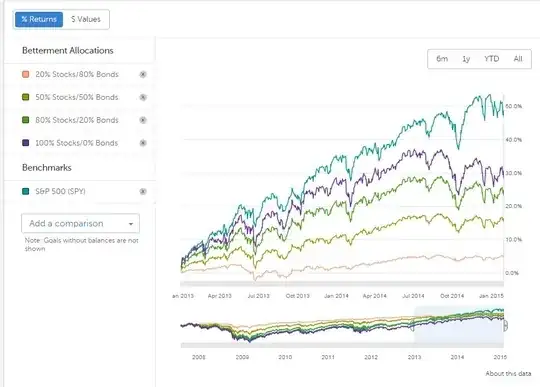

In contrast, a well-diversified portfolio invests in a balance between bonds and stocks, and the ratio of bonds to stocks is dependent upon the investment horizon as well as the individual's goals.

By constructing a portfolio from stock and bond ETFs across the world, Betterment reduces your portfolio’s sensitivity to swings. And the diversification goes beyond mere asset class and geography. For example, Betterment’s basket of bond ETFs have varying durations (e.g., short-term Treasuries have an effective duration of less than six months vs. U.S. corporate bonds, which have an effective duration of just more than 8 years) and credit quality. The level of diversification further helps you manage risk.

Dan Egan, Betterment’s Director of Behavioral Finance and Investing, examined the increase in returns by moving from a U.S.-only portfolio to a globally diversified portfolio. On a risk-adjusted basis, the Betterment portfolio has historically outperformed a simple DIY investor portfolio by as much as 1.8% per year, attributed solely to diversification.

Now, let’s assume that the investor at hand (Investor A) is a sophisticated investor who understands the importance of diversification. Additionally, let’s assume that he understands the optimal allocation for his age, risk appetite, and investment horizon. Investor A will still benefit from investing with Betterment.

Automating his portfolio management with Betterment helps to insulate Investor A from the ’behavior gap,’ or the tendency for investors to sacrifice returns due to bad timing. Studies show that individual investors lose, on average, anywhere between 1.2% to 4.3% due to the behavior gap, and this gap can be as high as 6.5% for the most active investors. Compared to the average investor, Betterment customers have a behavior gap that is 1.25% lower. How? Betterment has implemented smart design to discourage market timing and short-sighted decision making.

For example, Betterment’s Tax Impact Preview feature allows users to view the tax hit of a withdrawal or allocation change before a decision is made. Currently, Betterment is the only automated investment service to offer this capability. This function allows you to see a detailed estimate of the expected gains or losses broken down by short- and long-term, making it possible for investors to make better decisions about whether short-term gains should be deferred to the long-term.

Now, for the sake of comparison, let’s assume that we have an even more sophisticated investor (Investor B), who understands the pitfalls of the behavior gap and is somehow able to avoid it. Betterment is still a better tool for Investor B because it offers a suite of tax-efficient features, including tax loss harvesting, smarter cost-basis accounting, municipal bonds, smart dividend reinvesting, and more. Each of these strategies can be automatically deployed inside the portfolio—Investor B need not do a thing. Each of these strategies can boost returns by lowering tax exposure.

To return to your initial question—why not simply invest in the S&P 500? Investing is a long-term proposition, particularly when saving for retirement or other goals with a time horizon of several decades. To be a successful long-term investor means employing the core principles of diversification, tax management, and behavior management. While the S&P might look like a ‘hot’ investment one year, there are always reversals of fortune. The goal with long-term passive investing—the kind of investing that Betterment offers—is to help you reach your investing goals as efficiently as possible.

Lastly, Betterment offers best-in-industry advice about where to save and how much to save for no fee.