This would be a nice Raspberry Pi project for Mathematica, which comes bundled free on the Raspbian OS.

You can program it up and leave it running. It's not expensive and doesn't use much power.

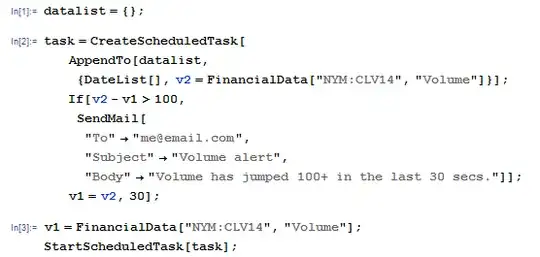

A program to monitor stock prices or volume could be written as simply as :-

This checks the volume of trades of Oct 2014 US crude oil futures every 30 seconds and sends an email if the volume jumps by more than 100.

The financial data in this example is curated from Yahoo. If specific data is not available or not updated frequently enough, if you can find an alternative online data source it's usually possible read the data in. For example, this is apparently real-time data :-

data = Import[

"http://www.investing.com/commodities/crude-oil-streaming-chart",

"Data"];

First[Cases[data, {"Crude Oil", __}, Infinity]]

{Crude Oil, 92.79, -0.67, -0.71%}

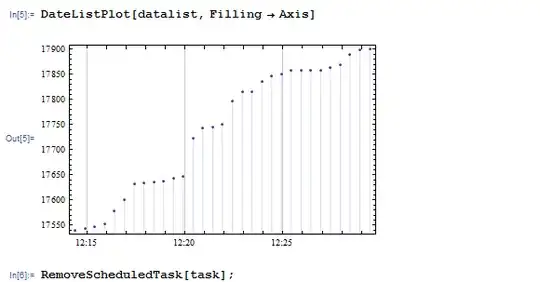

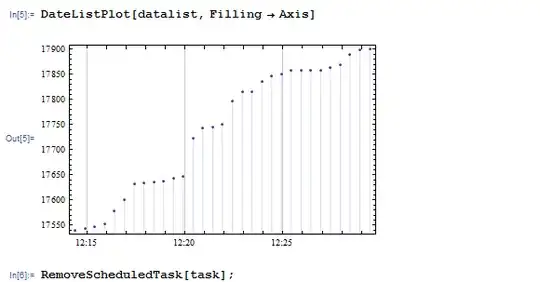

After leaving the above program running while writing this the volume of trades has risen like so :-

Edit

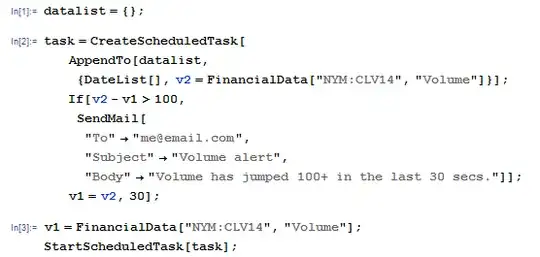

I just set this running on a Raspberry Pi. I had to use gmail for the email setup as described in this post: Configuring Mathematica to send email from a notebook. Anyway, it's working. Hope I don't get inundated with emails. ;-)

datalist = {};

task = CreateScheduledTask[

AppendTo[datalist,

{DateList[], v2 = FinancialData["NYM:CLV14", "Volume"]}];

If[v2 - v1 > 100,

SendMail[

"To" -> "me@email.com",

"Subject" -> "Volume alert",

"Body" -> "Volume has jumped 100+ in the last 30 secs.",

"From" -> "xxx...@gmail.com",

"Server" -> "smtp.gmail.com",

"ReplyTo" -> "xxx...@gmail.com",

"UserName" -> "xxx...@gmail.com",

"Password" -> "secret",

"PortNumber" -> 587,

"EncryptionProtocol" -> "StartTLS"]];

v1 = v2, 30];

v1 = FinancialData["NYM:CLV14", "Volume"];

StartScheduledTask[task];