Depending on who you have the loan through and how they figure the interest charges (whether daily, monthly, bi-monthly, etc. normally monthly I would assume), your interest is probably figured either daily or once a month.

Let's assume that it is figured daily, otherwise it wouldn't make sense to make bi-weekly payments.

At 4% Annual Interest on a $150,000 home loan the interested added each day is about $16.44, but it doesn't stop there because it is compounding interest daily so the next day it becomes 4% of 150,0016.44 (which is negligibly larger amount) and they will tack on another $16.44.

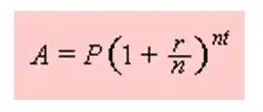

So what will happen is that the amount of interest you owe grows rather quickly, especially if you miss a monthly payment. Everyone knows that the faster you pay something off the less interest you pay, but not everyone knows the formula for compounding interest. a quick Google search rendered this site with a simple explanation

Compound Interest Formula

unfortunately this formula doesn't take into account the payments being made.

The big thing with making your payments bi-weekly rather than a bigger payment once a month is that you pay off some of that principle right away and it won't collect interest for 14 more days.

if the interest is only calculated once a month, make your full payment before the interest is calculated, the same goes for your credit cards.