I'm a 25-year-old recent college graduate in the US with a full-time job. My credit score is 766, grade C, 43rd percentile (VantageScore formula, not FICO).

My TransUnion report lists the following factors that impact my score:

- You have too few credit accounts

- Time since oldest account opened is too recent.

- You have no retail revolving accounts that can be used in determining a credit score.

- You have no real estate accounts that can be used in determining a credit score.

In the credit report, my 2 accounts are listed as "Satisfactory": my Bank of America credit card (open since 2006), and my car loan (opened last year and fully paid off).

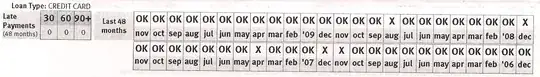

The only thing that stands out for me is that on the Bank of America account, 5 of the month boxes are marked "X", which is listed as meaning "Unknown", although I don't know what this means:

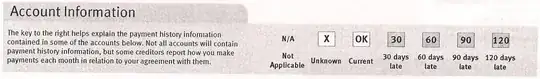

Legend:

Does my score sound lower than it should be for someone my age who has been reliable with his accounts? Would it be worthwhile for me to meet with my financial adviser to troubleshoot this?