This thinking has shifted and shifted again over the years. It used to be recommended that one should maintain an approximate 30% balance to achieve the highest score.

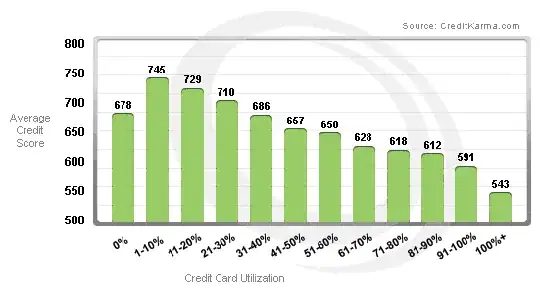

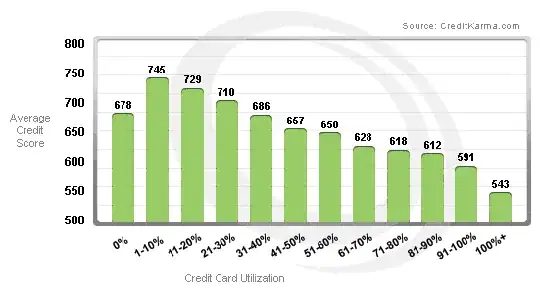

Credit Karma has an excellent random sample of 70,000 credit scores:

To achieve the highest score by this reliable sample, one should maintain a 1-10% balance.

Why the large drop at 0%? Creditors must be assured that a borrower can manage credit, namely regular interest payments.

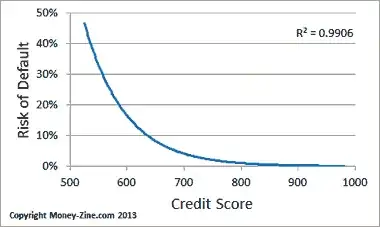

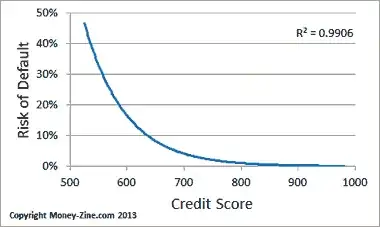

Credit scoring is fairly accurate at determining default risk as shown by VantageScore's calculation based upon TransUnion data:

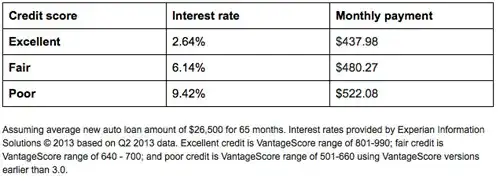

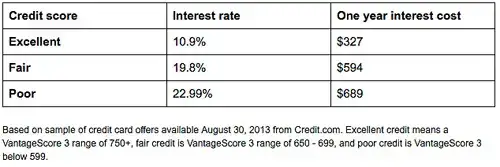

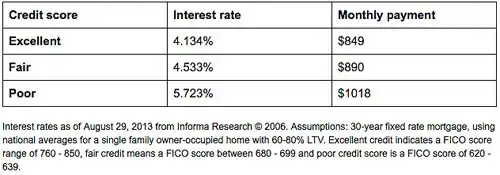

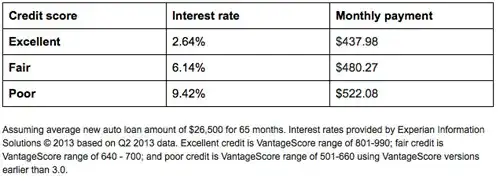

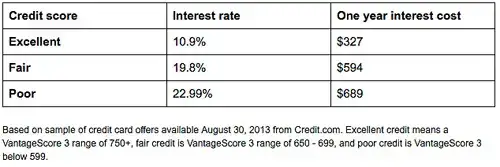

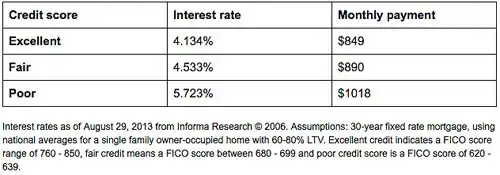

For creditors to be able to produce credit, the cost of default risk must be compensated, and this is done via the price of credit, the interest rate:

Auto loans

Credit cards

Mortgages

In short, one should keep a 1-10% balance of all available credit card credit, including secured credit cards.