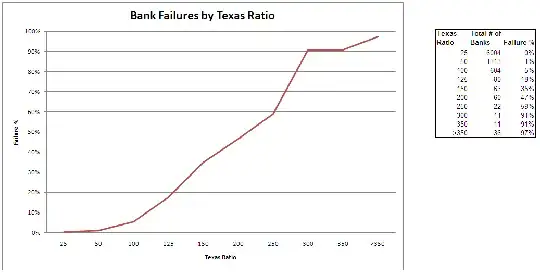

The Texas Ratio attempts to measure how well a bank can cover its losses on nonperforming loans. A ratio over 100 indicates the bank is in trouble.

I cross referenced the texas ratio for banks obtained from here (last updated 10/2009) with the latest list of bank failures from the FDIC (last updated 8/2010).

The ratio does appear to be a fairly good indicator of banks that go belly up.

If my bank has a ratio over 100 I would move my money to a safer bank. Especially since the FDIC is broke.

Would you move your money?

What Texas Ratio threshold would you tolerate?

Would you leave your money in a high texas ratio bank if the amount was covered by FDIC?

UPDATE: Many of you will be happy to know that the FDIC is looking to provide UNLIMITED coverage (instead of the current $250,000 limited coverage) for checking accounts. Of course, the FDIC is still broke but why let that stop them.

UPDATE (12/10/2010): Bank closures continue to rise and bring the FDIC to it knees:

The 151 closures nationwide so far this year tops the 140 shuttered in all of 2009 and is the most in a year since the savings-and-loan crisis two decades ago.

The growing bank failures have sapped billions of dollars out of the deposit insurance fund. It fell into the red last year, and its deficit stood at $8 billion as of Sept. 30.