Number A is my credit card number. The 4 groups don't have a meaning.

They do, actually. First digit is 4 for VISA, 5 for Mastercard, 6 for Discover/Diners Club, 3 for American Express/Diners Club (those are shorter than 16).

Also, first 6 digits for Visa and Mastercard are code numbers for the issuing institution. By these 6 digits anyone can know which institution issued the card, and what type of card it is (debit/credit, premiere or not, etc).

Number B: I have no idea. Might me my security code?

This is a security measure. These 4 digits must match the first 4 digits of your card number (the first 4 digits of the issuer code. The last 2 are card types for the issuer, though some different issuers may share the first 4 as well and only differ by the last 2). Amex cards don't have this (I'm not sure about Discover).

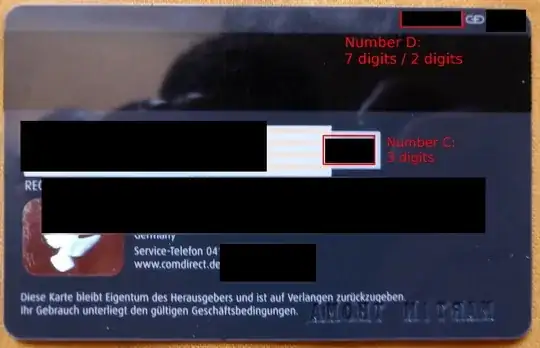

Number C is my security code.

Yes, this is called CVC or CVV2. It is used for card-not-present transactions. The purpose of the code is to verify that a payment card is actually in the hands of the cardholder/merchant, for example when using the card over the internet or phone.

On American Express cards this is 4 digits, and they appear on the front of the card.

Number D is eventually a card code (GD is Giesecke & Devrient)

This is bank-specific, so I guess whatever you said...:-)