On a bond chart, I always see the terms: Yield & Coupon, which seem to mean the same thing. What is the difference between these two terms?

On a bond chart, I always see the terms: Yield & Coupon, which seem to mean the same thing. What is the difference between these two terms?

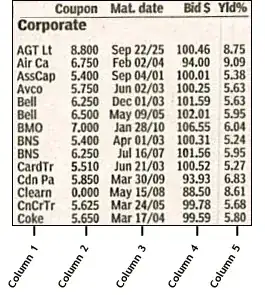

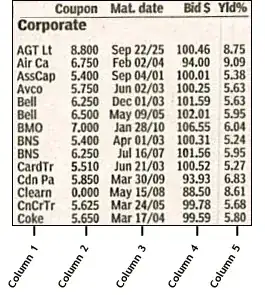

Coupon tells us the rate of returns(%) for the bonds when it was first issued based on issue price

Yield tells us the rate of returns(%) for the bond based on current price

Assuming a bond was issued at $1000 , promising to pay $50 yearly , it has a coupon rate of 5% & yield of 5%. However, if due to unforseen circumstances the bond price drops to $500, it still has a coupon rate of 5% but the yield is currently 10%.

Coupon (%) = Returns / Issue Price * 100

Yield (%) = Returns / Current Price * 100