I am not familiar with this broker, but I believe this is what is going on:

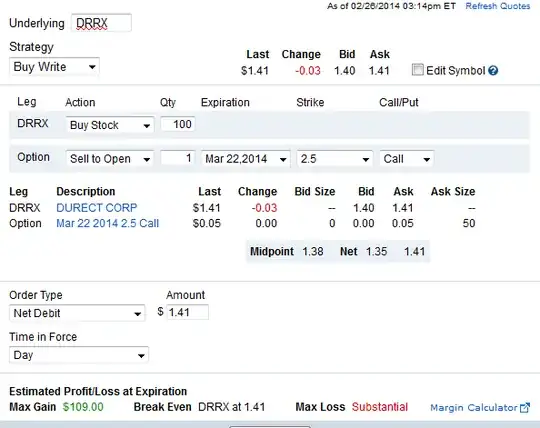

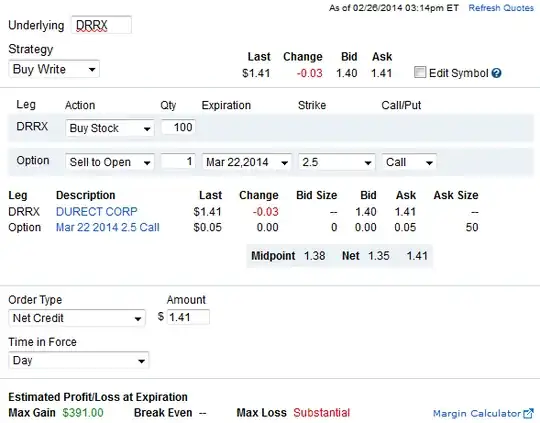

When entering combination orders (in this case the purchase of stocks and the writing of a call), it does not make sense to set a limit price on the two "legs" of the order separately. In that case it may be possible that one order gets executed, but the other not, for example. Instead you can specify the total amount you are willing to pay (net debit) or receive (net credit) per item. For this particular choice of a "buy and write" strategy, a net credit does not make sense as JoeTaxpayer has explained. Hence if you would choose this option, the order would never get executed. For some combinations of options it does make sense however.

It is perhaps also good to see where the max gain numbers come from. In the first case, the gain would be maximal if the stock rises to the strike of the call or higher. In that case you would be payed out $2,50 * 100 = $250, but you have paid $1,41*100 for the combination, hence this leaves a profit of $109 (disregarding transaction fees). In the other case you would have been paid $1,41 for the position. Hence in that case the total profit would be ($1,41+$2,50)*100 = $391. But as said, such an order would not be executed.

By the way, note that in your screenshot the bid is at 0, so writing a call would not earn you anything at all.