For my retirement savings, my strategy is to buy a decent amount of silver (8% of my salary, roughly 1 month) every year to put away in coin form. I am currently investing in nothing else for the long term. In the short term, I have money in the bank – I plan to buy a flat in a year so I don't want to lock it up too seriously.

I am determined not to touch this silver investment until I retire except in very extreme situations. I am afraid the European state pension fund – so Hungarian as well – is in huge trouble (finance & demographic), and if it is not solved, I will get just a miserable amount of money from it when I turn 65. So, practically, the silver shall be my primary source of pension unless I get a brilliant alternative idea or being convinced it is a bad concept.

Also a Hungary specific detail is the Government confiscated the private pension funds recently. I could make a statement I want to keep it (only 3% of the population did that), but the government holding back all the payments to this private pension funds now and redirects it to the state pension. The confiscated private pension's 95% assets are gone now.

I have no faith in the long run in stocks. First of all, it is a risky asset. Second of all, if you do trade, it takes a lot of time, and if somebody else does it for you, you need to pay them. Imagine in Eastern Europe if you open a bank account and put 70000 HUF (300 USD) on it, after 10 or 15 years literally the bank asks for money because your savings was taken by costs, low interest, and inflation. Sadly, I can't trust the brokers here too.

Here's what I see in favor of my silver plan:

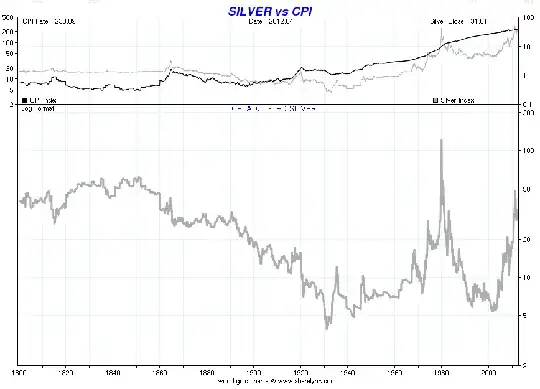

- Silver is pretty cheap now, hopefully it will be for a while.

- Silver is undervalued compared to gold. World reserve ratio is around 1 to 11, while price is around 1 to 60.

- Silver (and gold) with the current industry use would be extinct in 30 years. Which of course won't happen due expected price rising and recycling.

- Silver (and gold) always represented value over the human history.

- According to usdebtclock.org silver stock of the world is limited ~2oz/capita and as I mentioned, it is decreasing while population is increasing.

- Silver (and gold) is easy to carry if you need to move away for any reason unlike property.

I can say a single con:

- Nobody guarantees that silver will be considered as valuable asset in 30 years. But this is true for many-many assets.

Are there real, visible problems with my retirement plan? What are better alternatives?