I'm seeking a simple online calculator, or explicit instructions for a spreadsheet, for answering simple real-world scenarios like this:

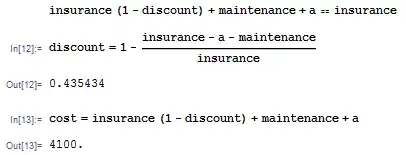

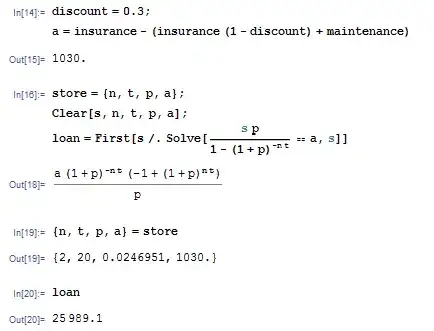

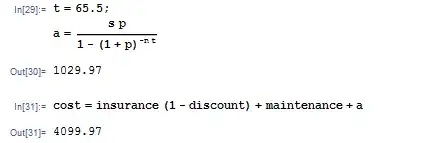

Our insurance company is offering a 30% discount on an $8200/year commercial policy, if we install sprinklers. The insurance is paid in two installments. We assume we can get an equity loan at 5% fixed. With a planning horizon of 20 years, and $400 a year in added inspection cost for the sprinkler, how much money can we spend on the system and break even?

or

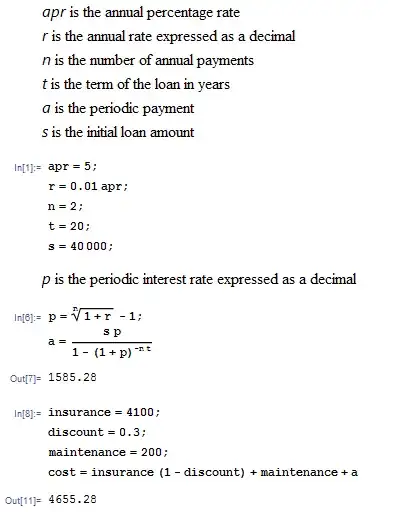

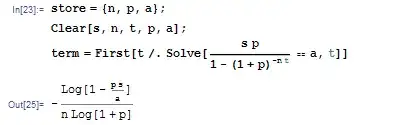

We'll save $2060 per year if we install a sprinkler system. The system will cost $40,000. Assuming we can borrow money at 5%, and zero cost for administration of the loan, what's the payback period on the sprinkler system?

The same calculation may apply to energy upgrades or any capital expenditure that results in a future savings. This is not a homework question, and I'm seeking a general answer that would work for a variety of scenarios.

I found many of the online mortgage calculators are poorly set up for this question.