The mathematics make it easier to understand why this is the case.

Using very bad shorthand, d1 and d2 are inputs into N(), and N() can be expressed as the probability of the expected value or the most probable value which in this case is the discounted expected stock price at expiration.

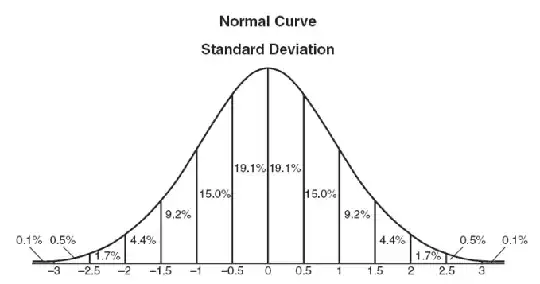

d1 has two σs which is volatility in the numerator and one in the denominator. Cancelling leaves one on top. Calculating when it's infinity gives an N() of 1 for S and 0 for K, so the call is worth S and the put PV(K). At 0 for σ, it's the opposite.

More concise is that any mathematical moment be it variance which mostly influences volatility, mean which determines drift, or kurtosis which mostly influences skew are all uncertanties thus costs, so the higher they are, the higher the price of an option.

Economically speaking, uncertainties are costs. Since costs raise prices, and volatility is an uncertainty, volatility raises prices.

It should be noted that BS assumes that prices are lognormally distributed. They are not. The closest distribution, currently, is the logVariance Gamma distribution.