A family member once told me about a method for reducing the term of a mortgage "significantly".

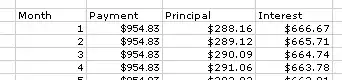

They didn't know (or I can't remember) the details but it had to do with certain mortgages that recalculate the interest quarterly. From what I remember the idea is to make the monthly payments on time and then pay off a chunk of the principal at the end of each quarter, which results in lower monthly payments the following quarter. Done over and over, this seemingly can shave quite a few years off a mortgage.

I don't know much about mortgages and so my questions are:

- is this as effective as I was told?

- where can I find more information about it?

- how would I ask a bank if they allow it? I can't imagine it being in their interest at all.

My first impression is that if I ever get a mortgage I'd want to do this to not end up paying zillions (of Euros) in interest over 40 years.