Profit or loss from the option is a different subject and depends on where the underlying is relative to the strike price at expiration.

What the Wikipedia section discusses is that one can (dynamically) replicate the payoff of the option, thereby obtaining a (fair) cost for the option. As a result, one can hedge out all of the price movements related to the drift of the stock and the price of the option only depends on the risk free rate only (and the other parameters entering into the Black Scholes equation).

Black Scholes computes the cost of implementing this strategy (the price of the option and the cost of the strategy must be identical, otherwise there would be arbitrage).

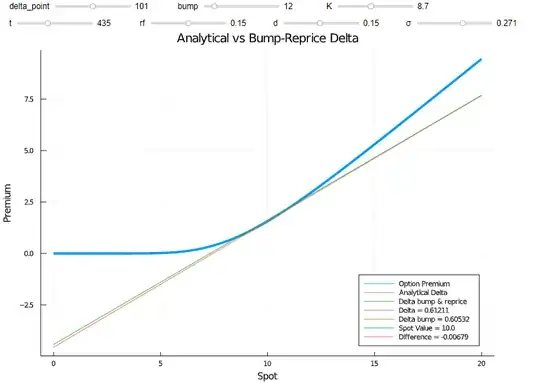

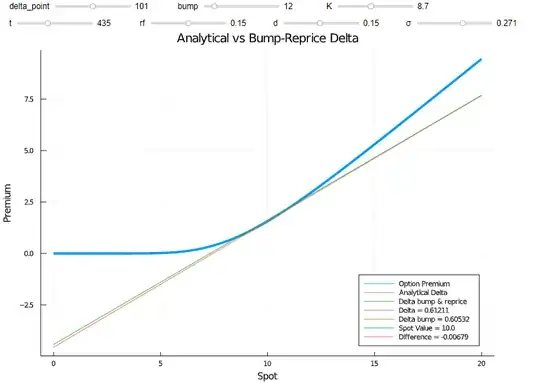

Hedging the option by buying / selling the underlying is called delta hedging. If you own a call option, you sell an amount of the underlying equal to delta. That way, if the price of the underlying increases, you gain with the option, but lose money in your underlying position. The total effect is roughly zero (for small changes in the underlying). The screenshot below shows delta, which is a linear approximation to the option price. As you can see, the difference between the actual change in the option value and the change according to delta is small as long as the change in the underlying is small (you can igore the bump & reprice part, this screenshot was just taking from another answer).

In the continuous time, dynamic hedging world of Black Scholes, this will work perfectly. It is not possible to do this in a real world setting and an interesting thought is the so called the Hakansson's paradox.

Either way, if you use Black Scholes, you can either plug in option prices and solve for (IV) implied vol (the standard way for price quoted exchange traded options) or plug in implied vol quotes to get the price (most OTC options are IV quoted or rely on computed vol surfaces). What you should not do is to use historical vol in the Black Scholes equation because this will typically misprice options and be of little use.