I have some bank accounts with international banks like SC/HSBC/Citi.

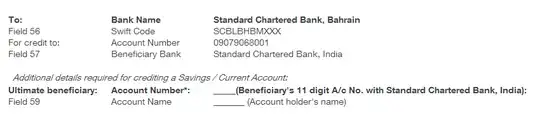

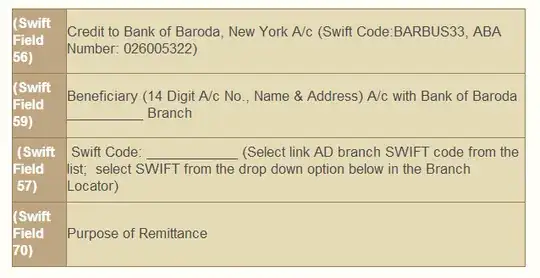

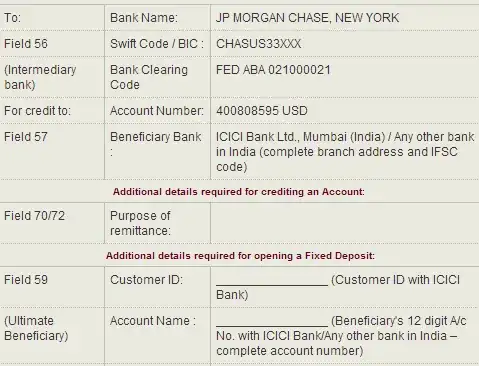

Here is the template which they provide for international wire transfers.

Is it necessary to provide Correspondent Bank info to sender? Their bank can't determine it on their own using their networks? And why some banks ask for receiver's address while some other banks ask for receiver's bank branch address?

On #3 example , you can see bank info confuses sender to which bank account he is wiring to and some banks don't even provide all these fields in their online banking dashboard. The bank on #3 have around 3 correspondent banks for USD transaction, is there a reason to prefer one over another?