What are the best software tools for personal finance?

Please list what you like about the software you use.

What are the best software tools for personal finance?

Please list what you like about the software you use.

Mint.com—Easy solution to provide insight into finances.

Pros:

Cons:

GnuCash—Great for the meticulous who want to know every detail of their finances.

Pros:

Cons:

I like You Need A Budget (YNAB)

Pros:

Cons:

Pros:

Cons:

Mvelopes is envelope-style budgeting in an online application. I've tried all of the other applications and I choose to pay for this one for the following reasons:

Pros:

Cons:

I use iBank for Mac to keep track of my expenses. I also use the iPhone version since they can sync over Wi-Fi and I can capture expenses right on the spot instead of trying to remember what I spent on when I turn on my laptop.

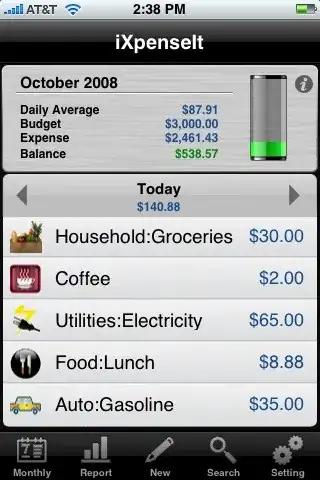

For iPhone: iExpenseIt

PROS:

CONS

For any android device you can try: Daily Expense Manager - to track your expenses and a host of other apps to suit your specific needs.

Emergency Account Vault (Windows)

I use it to store info about all of my accounts/assets in an encrypted document. It's more for keeping track of everything that is in your name than managing money. Good for situations when you need to quickly look up info about a specific account you own.