I owe about $6k in back taxes, and simply don't have the money--it's hard for me to find even minimum wage jobs in the current economy, and I am burdened with consumer debt. After speaking with the IRS in person, it was suggested that I submit an Offer in Compromise. So I've been going through the paperwork and trying to fill in the blanks.

They ask on the form what your "assets" are, and I only have one. It's my car...but it's not really an asset because I owe the bank $5000 for the car loan and my car's blue book value is only about $3000. Selling it is a trick because I'd have to borrow money just to get the title, and after that I'd be down another $2000. :-(

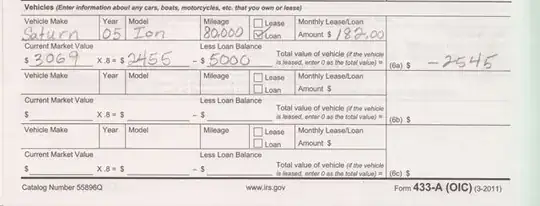

How do I fill out the form for "assets"? Do I put a negative number? Here's what I filled in based on what I know:

`

`

They ask specifically about your car and its value, but my car has a negative value. The online qualifying questionnaire does not accept negative numbers. Is a car that is underwater like this still considered "your vehicle" and an "asset"? For me it is a liability!

Thanks for any guidance...