If I own a company whose assets are 100 barrels of oil valued at $10,000 in some currency, and the currency's value suddenly drops by a factor of two, I would expect that my company is now suddenly "worth" $20,000 in this newly devalued currency (or in other words, still close to the same price as denominated in any alternate currency).

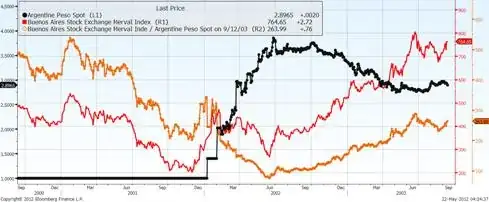

I've seen this happen in certain situations, where, when a currency's exchange rate fluctuates, the market as denominated in that currency moves in a closely (inversely) correlated way. Zimbabwe was also a good example, as hyperinflation kicked in, the stock market rallied (as denominated in Zimbabwe dollars).

I can understand that with a rapid devaluation, investor confidence could be spooked, and that the upswing might not be as extreme as it was in Zimbabwe. Regardless, there should at least still to some extent be a sharp change in "price" consistent with devaluation.

I've read that on December 18, 1994, Mexico devalued its peso by 18%, and by March it lost half of its value. When I look at a chart of the IPC Mexican stock market index (which seems to be denominated in pesos?) I don't see anything like an 18% jump in share prices on December 18th, and do see a steady decline in the index as the peso fell. The chart looks more like what I might expect to see if it were denominated in dollars.

How does this happen? Is the chart denominating the index in the same pesos consistently? Do I have my dates and devaluation amounts off?

Do none of these companies have any assets that are priced internationally, and thus depend entirely on local peso revenues for their profits and valuation? I find that hard to believe.

Am I completely miss-understanding something? Was there something more to the devaluation mechanism that could allow the market to sustain this valuation?