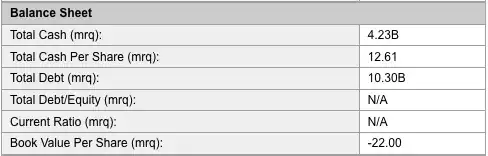

I'm interested in American Airlines stock (AAMRQ). Recently they announced a merger with US Airways. The resulting company is said to be worth $11B (USD). Tom Horton, the CEO, said that after creditors are paid out, stockholders of AAMRQ stand to receive 3.5% of the new company. If we assume an 11 billion dollar valuation, 3.5% of that would be $385,000,000. There are ~335,000,000 outstanding shares of AAMRQ. My math tells me these shares should be worth about $1.15/share. However, as of the merger announcement the shares of AAMRQ have shot up drastically from ~$1.20 to ~$2.53.

So my question is - how come the market thinks there's so much value in AAMRQ? A price of 2.50 gives the company a market cap of $837,000,000! Is it possible it will all come tumbling down in the next few days?