Abbott Labs (ABT) split into two companies (ABT and ABBV) at the start of the new year. Shareholders of ABT on Dec. 12 received one share of ABBV for each share of ABT they owned on that date. As I understand it, that means if I bought ABT on Dec. 13, when it was trading around $65 (appx. the same as the day before), I would not receive any shares of ABBV. Yet when the stock officially split on the new year, the new ABT started trading more than 30 points down, with the remainder in ABBV.

Is that correct? If so, why would anyone buy ABT stock at that price after the 12th? Did the people who sold ABT between the 12th and the 31st receive shares of ABBV, essentially for free? If not, what did the Dec. 12th deadline actually mean?

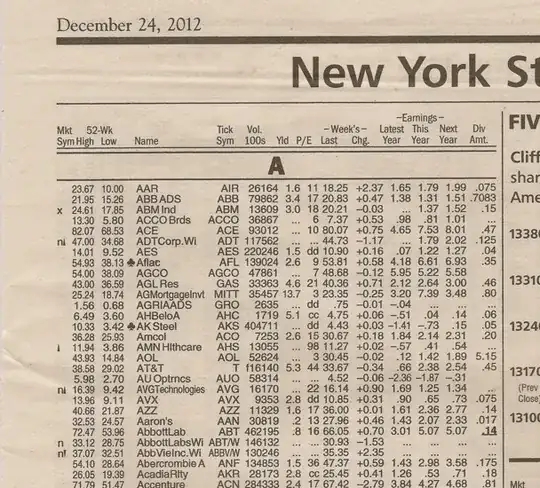

Update: A lot of resources, notably Google Finance, only provide adjusted historical data, but Yahoo Finance does still list the actual prices for ABT at the time of the split.

Notably:

| Date | Close | Volume |

| Dec 12, 2012 | 66.01 | 19,150k |

| Dec 13, 2012 | 65.32 | 14,318k |

| Dec 31, 2012 | 65.50 | 19,062k |

| Jan 2, 2013 | 32.05 | 20,266k |

As I understand it, anyone buying ABT between the 13th and the 31st did not receive a share of ABBV, yet people were still willingly paying $60+/share for a stock they knew would halve in value come the new year. Why?