Curious, why are you interested in building/improving your credit score?

Is it better to use your card and pay off the bill completely every month?

Yes.

How is credit utiltization calculated?

Is it average utilization over the month, or total amount owed/credit_limit per month?

It depends on how often your bank reports your balances to the reporting agencies. It can be daily, when your statement cycle closes, or some other interval.

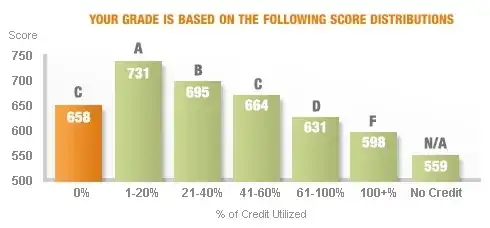

How does credit utilization affect your score?

Closest to zero without actually being zero is best. This translates to making some charges, even $1 so your statement shows a balance each statement that you pay off. This shows as active use. If you pay off your balance before the statement closes, then it can sometimes be reported as inactive/unused.

Is too much a bad thing?

Yes.

Is too little a bad thing?

Depends. Being debt free has its advantages... but if your goal is to raise your credit score, then having a low utilization rate is a good metric. Less than 7% utilization seems to be the optimal level.

"Last year we started using a number, not as a recommendation, but as a fact that most of the people with really high FICO scores have credit utilization rates that are 7 percent or lower," Watts said.

Read more: http://www.bankrate.com/finance/credit-cards/how-to-bump-up-your-credit-score.aspx

Remember that on-time payment is the most important factor. Second is how much you owe. Third is length of credit history. Maintain these factors in good standing and you will improve your score: http://www.myfico.com/CreditEducation/WhatsInYourScore.aspx