Here are some calculations for an investment which yields a final value of $ e million ($2,718,282) from an initial value of $ 1 m.

The logarithmic or continuously compounded return is given as:-

Vf = 2,718,282

Vi = 1,000,000

rlog = ln(Vf/Vi) = 1.0 = 100 %

This is a logarithmic return, or nominal return (continuously compounded) of 100%.

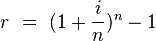

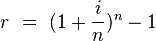

The effective annual rate can be calculated by:-

where i is the logarithmic or continuously compounded nominal rate.

i = rlog = 1.0 = 100%

r = e^i - 1 = 1.718282 = 171.8282 %

An effective annual return of 171.8282% produces the final value of $ e million.

Of course, the effective return can also be calculated as:

r = Vf/Vi - 1 = 1.718282 = 171.8282 %

Now considering monthly periodic returns

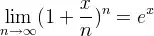

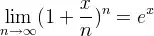

The effective annual rate calculated from a periodically compounded nominal return is:

where n is the number of compounding periods.

Rearranging this formula, and using the previously calculated effective annual rate (which produced $ e million), the annual nominal rate compounded monthly is calculated:

r = 1.718282 = 171.8282 %

n = 12

i = n*((r + 1)^(1/n) - 1) = 1.0428486 = 104.28486 %

Note how this differs from the 100% calculated for the continuously compounded nominal rate. As n increases the periodic nominal rate approaches the continuously compounded nominal rate, as demonstrated by the limit formula:

For example, the nominal rate compounded daily (with n = 365) is 100.137%, which is somewhat closer to 100% than the nominal rate compounded monthly.

From the annual nominal rate compounded monthly, the monthly compounding rate can be found:

m = i/n = 1.0428486/12 = 0.08690405 = 8.690405 %

Checking by compounding for 12 months: (m + 1)^n - 1 = 1.718282

The monthly compounding rate can also be calculated directly from the logarithmic rate, or annual continuously compounded nominal rate:

i = rlog = 1.0 = 100 %

n = 12

m = e^(i/n) - 1 = 8.690405 %