I’ve been researching online and believe the 1099-R I received may be incorrect. However, I’ve come across some conflicting answers, so I wanted to ask here to get your thoughts. To give you some background: I initially decided to consolidate my 401k accounts into my current plan. But after rolling one over, I noticed how high the fees were with our current company. As a result, I decided to do a direct rollover of both my 401k and Roth 401k into a Rollover IRA and Roth IRA. I’ll copy and paste the email correspondence I’ve had with our plan’s TPA below. Please take a look and let me know if you think I’m on the right track.

My initial email to our TPA

"Last year, I completed a direct rollover of funds previously transferred from my old 401k and 401k Roth into a rollover IRA and Roth IRA. I confirmed that the funds were correctly distributed into the appropriate IRA accounts.

While working on my taxes, I entered the information from the 1099-R I received, but it appears to indicate that I owe taxes on the rollover. My understanding was that, since this was a direct rollover from a 401k to a rollover IRA and from a 401k Roth to a Roth IRA, there should be no tax liability.

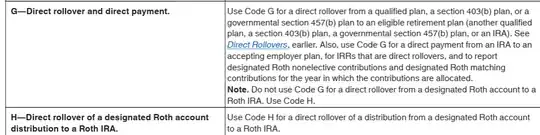

I consulted a CPA, who reviewed the details and advised that the 1099-R I received may not be correct. He mentioned that I should have received two separate 1099-R forms, one for the traditional 401k and one for the Roth 401k, with different Box 7 codes. The traditional 401k rollover should be coded as "G," which matches the form I received, but the Roth 401k rollover should be coded as "H."

I’ve attached a snippet of the transaction details for the Roth 401k. It shows $7,585 as a taxable amount, which matches the taxable income listed on the 1099-R. However, unless I am misunderstanding something, that money should be tax-free since it represents post-tax contributions.

Could you please review this and clarify the tax statement of my rollover?"

This was their response

"I heard back from John Hancock regarding your Roth IRA rollover. Here is the reason that the earnings portion of your rollover was considered to be taxable.

Any amount over the original Roth 401(k) contributions (which was confirmed upon receipt of the rollover) is considered to be earnings, which are taxable when moved to a Roth IRA, unless the participant has met the specific Roth conditions for tax-free treatment which are:

The Roth account has been in place for 5 years (Roth start year is 2013, so this condition is met). The participant has reached 59 ½ years of age. (This condition is unmet since the participant's date of birth is in 1994, making them only 30 years old)."

Am I correct thinking that this should be a untaxable event?