I'm the person who asked the original question about leverage and mentioned isolated margin trading. I did some research and I will now try to summarise what I found.

How Exchanges Try to Mitigate the Problem

- Liquidation Engines: Most reputable exchanges have sophisticated systems that try to execute rapid-fire liquidations the moment your account hits the liquidation price. They use techniques that break up your position to find the maximum buyers quickly.

- Insurance Funds: Some exchanges maintain an insurance fund to cover scenarios where a position experiences losses greater than the account's margin. These funds are usually built up using a small portion of fees from margin traders.

- Risk Management Mechanisms: Exchanges monitor market liquidity and adjust liquidation procedures during wild volatility. Sometimes they temporarily suspend margin trading in highly illiquid coins.

My Experience with Isolated Margin Trading

I experimented with 100x Bitcoin trades on CoinEx, a Hong Kong-based exchange known for offering a wide range of altcoins and margin trading options. It was an interesting experience – sometimes I doubled my position, and sometimes I lost it all. I DO NOT WANT TO ADVERTISE MARGIN TRADING IN THIS SECTION!

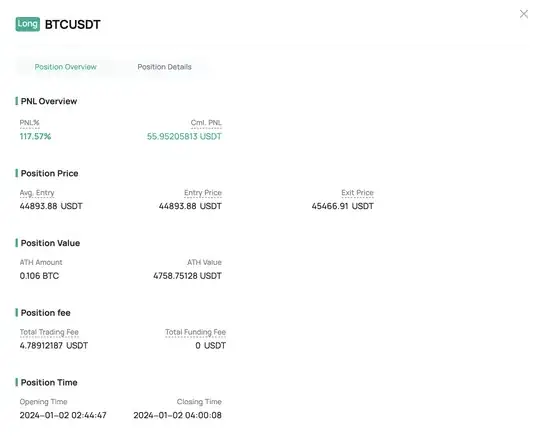

- Type: Long Bitcoin (BTC) with 100x Leverage

- Position size: 0.106 BTC

- Average entry price: 44893.88 USDT

- Exit price: 45466.91 USDT

- Profit and loss (PNL): 117.57% or 55.95205813 USDT

- Position fees: 4.78912187 USDT

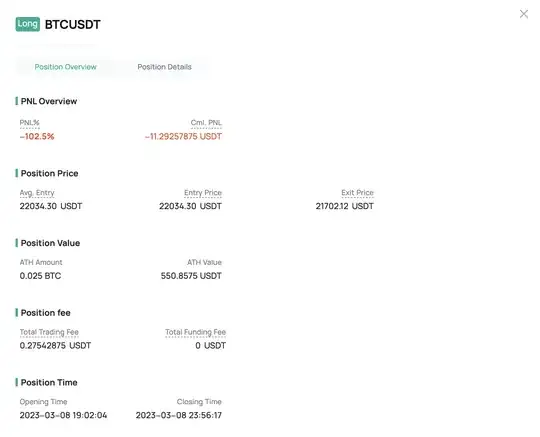

- Type: Long Bitcoin (BTC) with 100x Leverage

- Position size: 0.025 BTC

- Average entry price: 22034.30 USDT

- Exit price: 21702.12 USDT

- Profit and loss (PNL): -102.5% or -11.29257875 USDT (-102.5% equals everything on my margin account)

- Position fees: 0.27542875 USDT

I tried to break it down as well as I could with some of my real-world examples. I haven't verified my identity on this exchange, so I highly doubt that I am even able to go into debt.

Disclaimer: Isolated margin trading involves substantial risk. It amplifies both potential profits and losses. You could lose your entire margin for a specific position. Before participating, carefully assess your financial situation and risk tolerance.