This question is very close, but not exactly mine since this person asking the question says their facility had a closure and might not be on a payroll for a period of time. My question is about being on two payrolls relatively soon (within the next 3 weeks).

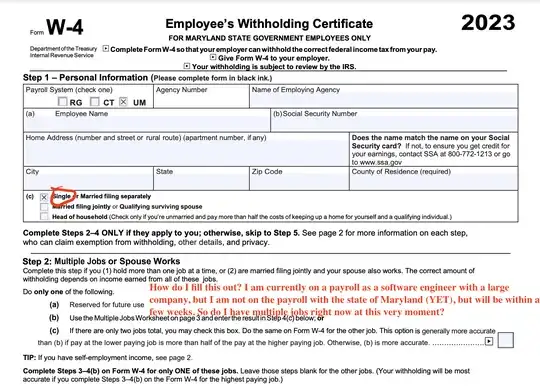

I am trying to fill out the W-4 for Maryland State Government Employees only form (which is very similar and not to be confused with the general W-4).

I will (soon after filling out the W-4 form) become a Maryland State Government employee in the next few weeks and this will become my second job. My first job is a software engineer with a large company. So as of this writing I am on a single payroll, but within the next few weeks I should be on 2 payrolls. I am single.

Question : How should I fill out Step 2?

Step 2 : Multiple Jobs or Spouse Works

Since I am a software engineer for a large company and on their payroll, but not yet on the payroll of the state of Maryland, currently I don't have multiple jobs. But within the next few weeks I will also be on an additional payroll with the state of Maryland and will have two jobs. So how should I answer Step 2? More specifically, Step 2 says to fill it out if

you (1) hold more than one job at a time,

My thinking is since I don't technically hold 2 jobs right now, then I should leave step 2 blank.

I see there is also option 2c which says

If there are only two jobs total, you may check this box

What should I do?

I would really appreciate tax experts to advice me on this one.