US Fed Tax: I am trying to understand difference between Estate Exclusion Amount and Lifetime Gift Exclusion Amount

When I google "irs lifetime gift tax exemption 2023", I get this result from https://smartasset.com/estate-planning/gift-tax-explained-2021-exemption-and-rates

That's because the IRS allows you to give away up to $18,000 in 2024 and $17,000 in 2023 in money or property to as many people as you like each year. The government also exempts $13.61 million in 2024 and $12.92 million in 2023 in gifts from tax over a person's lifetime.

But I cannot find this type of explanation in irs.gov

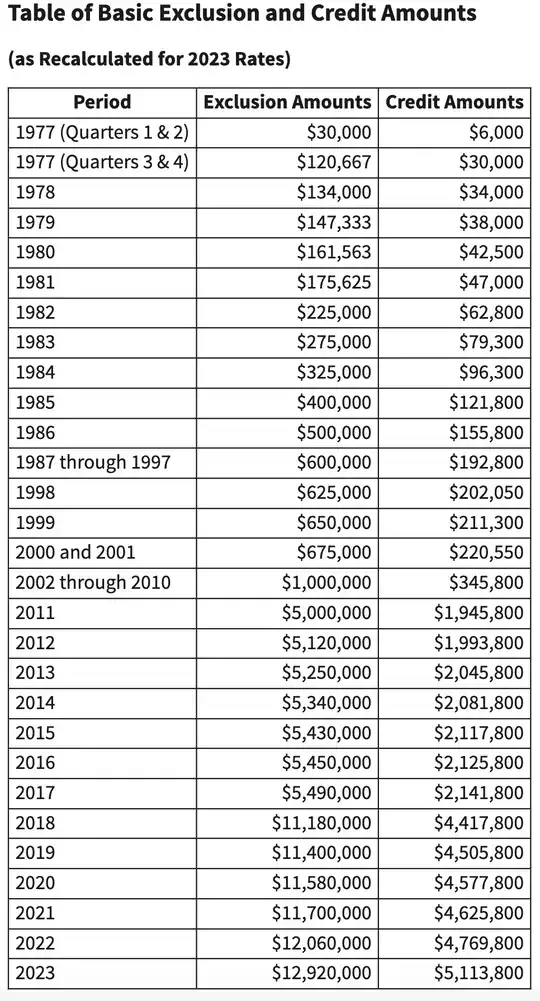

When I search I get, https://www.irs.gov/instructions/i709#en_US_2023_publink1000292380 and it gives this table:

Table of Basic Exclusion and Credit Amounts (as Recalculated for 2023 Rates)

Where does it say these amounts are limits of gifts given in lifetime rather than from an Estate at a person's death.

Where does it say it is legal for someone to give $12-something million to an individual within a given year ONLY once and not be taxed for giving this $12-something million gift.

Please guide