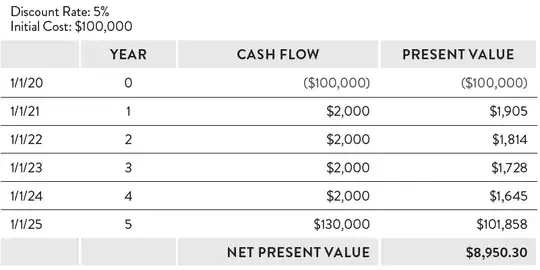

I'm reading a real estate investing book that provided the following example.

- You finance a property for $100,000 using a HELOC with a 5% interest rate.

- The property generates $2,000 in cash flow each year for four years.

- You sell in the fifth year for $130,000.

To analyze this deal, the authors computed the net present value of the deal using a 5% discount rate (Equal to the interest rate on the loan.). They said you would do this to determine whether you can "...cover the cost of debt." This doesn't make sense to me. It seems to me that as long as you make a profit overall then you are covering your cost of debt.

Calculating net present value makes total sense to me when the discount rate represents the amount you expect to make in alternative investments, but it doesn't make sense to me when it's based off of the interest rate of a loan.

Am I missing something here? How is it that a discount rate could be used to determine whether you are going to break even on a financed deal?

UPDATE 10/11/2023

Since some people are asking for more context about how this problem appeared in the book, I am copy/pasting the exact text below.

...in the investing and finance world, we’re often dealing with projects that are financed through debt. When financing a deal, the question often isn’t “Do the returns on this investment beat out the returns on an alternative investment?” Instead, the question is often “Are the returns on this investment enough to surpass our cost of debt?”

Let’s say that we have the opportunity to invest $100,000 in a deal that would return $2,000 per year for four years, and then $130,000 in Year 5.

Further, let’s say that we didn’t currently have the cash to make this investment, but we knew that we could take out a home equity line of credit (HELOC) on our personal residence to acquire the $100,000 to invest... The interest rate on the HELOC in this example would be 5 percent.

Does it make sense to borrow money against our personal residence at 5 percent interest for this investment? NPV can give us that answer:

Our NPV in this scenario is positive. In other words, we would make money—in today’s dollars—by borrowing $100,000 at 5 percent interest for five years to do this deal. Specifically, the return on this deal would surpass our hurdle (discount rate) of 5 percent interest on the loan we took out to fund the deal.