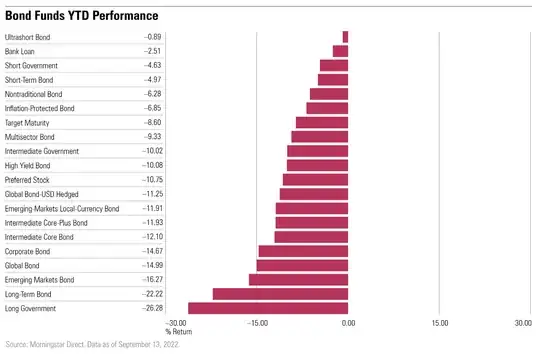

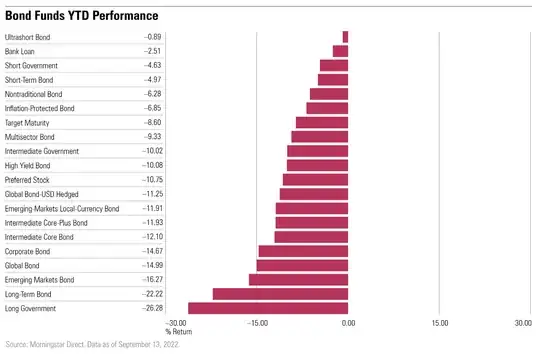

If you buy a bond ETF today, you will neither earn distribution yield nor YTM. Generally, you will not know what you will earn going forward. This is similar to stocks, although less volatile usually, although long term government bond ETFs were down almost 30% last year Morningstar.

I'd advice you to be very careful when you look at YTM of ETFs. This question and the associated answers highlights what the problem will be: almost no ETF holds bonds to maturity. This also holds for your example ETF which can only hold bonds with 1-3 years of maturity. Therefore, YTM will never be a value that the fund ever realizes (unless maybe by pure chance).

Distribution yield is backward looking, but it is at least based on what you actually received. That said, calculations vary from fund to fund, which makes it difficult to compare.

Overall, while bond ETFs are a quick and easy way to diversify, the actual returns you will get are volatile and unpredictable, just like almost all investments. If you want to be sure to get a certain yield, buy a single treasury bond and hold until maturity. All else will just expose you to price fluctuations.