Penny stocks are subject to online fraud. Specifically, somebody steals passwords and illegally gains access to other's accounts. Due to the low liquidity of some penny stocks, fraudsters can drive the price up significantly by placing a large buy order. They then sell the stock with another account they control, gaining a large profit. In other cases, they may charge others with penny stock positions for this service.

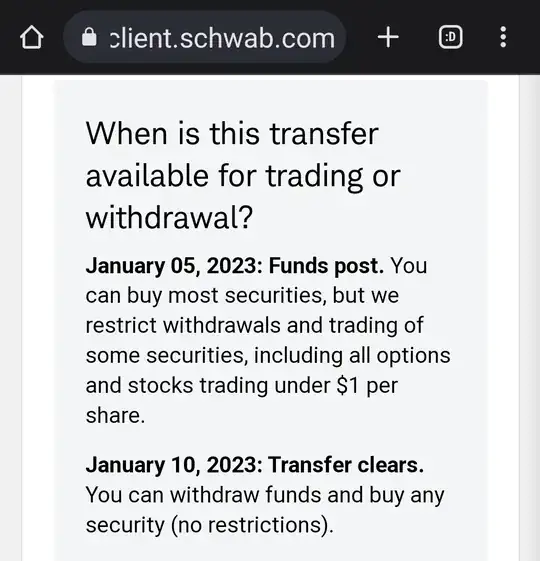

The money from the fraudulent buy order likely comes from liquidating the stolen account's positions. The restrictions on unsettled funds trading give more time to detect this fraud, otherwise the liquidation and purchase can come nearly immediately.

You'll find many brokers have similar security measures. Mine requires 2-factor verification for any penny stock trades.