Back in the summer I received a tax bill saying I owe money for unemployment, but I do not as I never filed it. It's most likely fraud claim under my name or company.

Below are the redacted documents showing they corrected my 1099G, but I still got a bill for it. On the back of that bill it says I can fight it with a "Conciliation conference" or "Division of Tax Appeals". What should I do? or is there some place I can just call to make this resolved?

I downloaded and filled this 1099g review form:

https://dol.ny.gov/system/files/documents/2021/12/lo1099rq_12-21.pdf

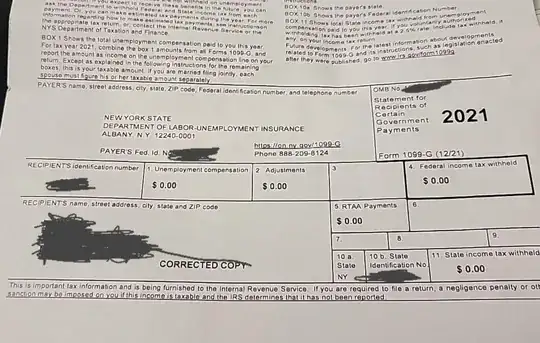

And in Nov I got an updated 1099G, which shows updated copy with $0.

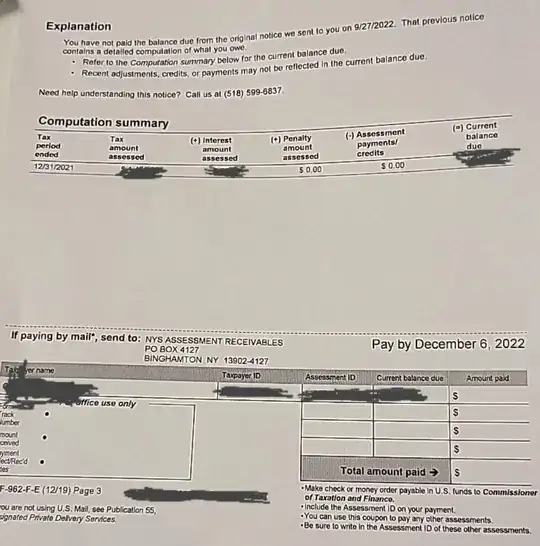

Then in DEC 2022, i receive a letter saying I owe money:

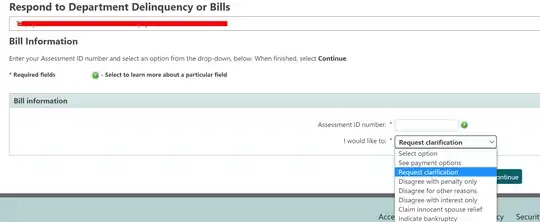

When I try to filr for the "Conciliation conference" on the my.ny.gov website, i get hit with these options. Picking disagree other reasons just hits you back to the main page. I'm not sure what to do next.