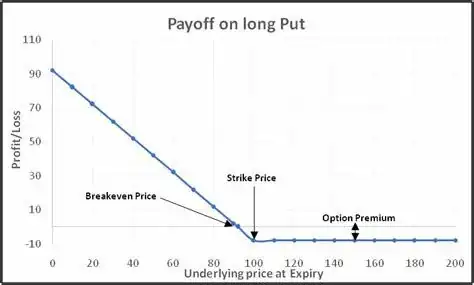

With zero days to expiry, the value of the option with respect to the underlying is essentially a straight line kinked at the strike:

If the underlying price is below the strike (In-The-Money), the value of the option changes 1-1 with every change in the underlying, so the Delta is 1. If the underlying is above the strike (Out-of-The-Money), the option is worthless regardless of changes in the underlying, so the Delta is zero.

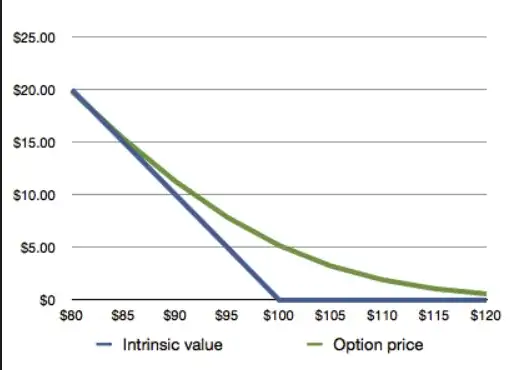

With 10 days to expiry, the value graph is no longer a straight line, but it now a smooth curve to account for the possibility of the underlying crossing the strike:

Now, the ITM value does not change 1:1 with the underlying and the Delta is slightly less than 1, and the OTM value is no longer zero and does change, so it's Delta is slightly greater than zero.

This effect is not directly because of "theta", but is because of the additional possibility of the option crossing the strike between now and expiry.