What is the best way to change $30,000 dollars from the U.S., into Euros to Europe ? Is an international bank account the best solution? If not, then what?

5 Answers

To transfer US$30,000 from the USA to Europe, ask your European banker for the SWIFT transfer instructions. Typically in the USA the sending bank needs a SWIFT code and an account number, the name and address of the recipient, and the amount to transfer. A change of currency can be made as part of the transfer.

The typical fee to do this is under US$100 and the time, under 2 days. But you should ask (or have the sender ask) the bank in the USA about the fees. In addition to the fee the bank may try to make a profit on the change of currency. This might be 1-2%.

If you were going to do this many times, one way to go about it is to open an account at Interactive Brokers, which does business in various countries. They have a foreign exchange facility whereby you can deposit various currencies into your account, and they stay in that currency. You can then trade the currencies at market rates when you wish. They are also a stock broker and you can also trade on the various exchanges in different countries. I would say, though, they they mostly want customers already experienced with trading. I do not know if they will allow someone other than you to pay money into your account. Trading companies based in the USA do not like to be in the position of collecting on cheques owed to you, that is more the business of banks. Large banks in the USA with physical locations charge monthly fees of $10/mo or more that might be waived if you leave money on deposit. Online banks have significantly lower fees. All US banks are required to follow US anti-terrorist and anti-crime regulations and will tend to expect a USA address and identity documents to open an account with normal customers.

A good international bank in Europe can also do many of these same sorts of things for you. I've had an account with Fortis. They were ok, there were no monthly fees but there were fees for transactions. In some countries I understand the post even runs a bank.

Paypal can be a possibility, but fees can be high ~3% for transfers, and even higher commissions for currency change. On the other hand, it is probably one of the easiest and fastest ways to move amounts of $1000 or less, provided both people have paypal accounts.

- 3,395

- 20

- 20

The right answer to this question really depends on the size of the transfer. For larger transfers ($10k and up) the exchange rate is the dominant factor, and you will get the best rates from Interactive Brokers (IB) as noted by Paul above, or OANDA (listed by user6714).

Under $10k, CurrencyFair is probably your best bet; while the rates are not quite as good as IB or OANDA, they are much better than the banks, and the transaction fees are less. If you don't need to exchange the currency immediately, you can put in your own bids and potentially get better rates from other CurrencyFair users.

Below $1000, XE Trade (also listed by user6714) has exchange rates that are almost as good, but also offers EFT transfers in and out, which will save you wire transfer fees from your bank to send or receive money to/from your currency broker. The bank wire transfer fees in the US can be $10-$30 (outgoing wires on the higher end) so for smaller transfers this is a significant consideration you need to look into; if you are receiving money in US, ING Direct and many brokerage accounts don't charge for incoming wires - but unless you have a commercial bank account with high balances, expect to spend $10-$20 minimum for outgoing. European wire transfer fees are minimal or zero in most cases, making CurrencyFair more appealing if the money stays in Europe.

Below $100, it's rarely worth the effort to use any of the above services; use PayPal or MoneyBookers, whatever is easiest.

Update: As of December 2013, CurrencyFair is temporarily suspending operations for US residents:

Following our initial assessment of regulatory changes in the United States, including changes arising from the Dodd-Frank Act, CurrencyFair will temporarily withdraw services for US residents while we consider these requirements and how they impact our business model.

This was a difficult and very regretful decision but we are confident we will be able to resume services in the future. The exact date of re-activation has not yet been determined and may take some time. We appreciate your patience and will continue communicating our status and expected return.

- 179

- 1

- 4

Be careful of transferring through the large banks. They may say no/low fees, but they hide their cut in the spread, or worsen the exchange rate, to their favor.

- 79

- 1

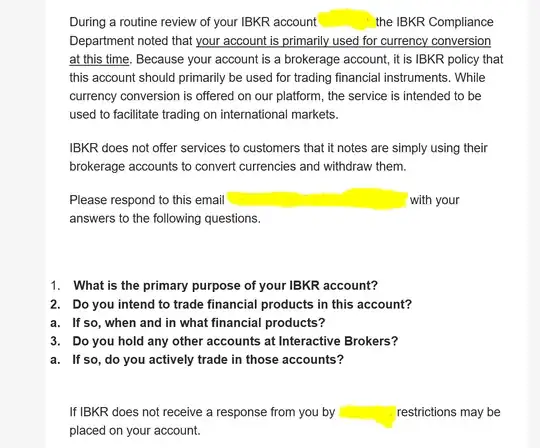

Dr. Paul Brewer's answer overlooks this pitfall with Interactive Brokers. Beware!

Interactive Brokers may close the account if it is ONLY used for exchanging money. Interactive Brokers offers by far the cheapest solution for exchanging and transferring money internationally, but of course they do not make much money from this. Their primary goal is to have clients who also invest money or do trading. Therefore, their compliance department may contact customers who only use the account for currency conversion and threaten to close the account (see image below). Our recommendation: Either only use Interactive Brokers for individual large international transfers (so that you do not need to worry about closing the account afterwards) or consider using the account also to save for retirement or general investing purposes.

You would probably be better off wiring the money from your US account to your French account. That IMHO is the cheapest and safest way.

It doesn't matter much which bank to use, as it will go through the same route of SWIFT transfer, just choose the banks with the lowest fees on both sides, shop around a little.

- 190,863

- 15

- 314

- 526