I have a pretty simple question for primarily programmers in the USA, but it also goes for those elsewhere.

I'm in Sweden. A couple of years ago, just when I had finally set up an automated system to fetch my bank transaction records automatically, the bank killed that entire "feature" (really a kind of abused "hole"), making it 100% impossible to automate keeping track of your finances, in turn forcing me to spend hundreds of active hours designing an elaborate and quite insane system to automate my personal bookkeeping as much as possible.

As I've just spent yet another day stomping out yet another bug in my system, and read old computer magazines from 1996 where this was all automated through dial-up modems and Windows/DOS desktop applications, I find myself once again wondering: is this some unique dumbed-down consumer slave mentality for Sweden, or is it the same now everywhere else? In particular, in the USA?

Are there millions of programmers out there who in recent years have been forced to design their own bookkeeping system, just like myself, and find ways to semi-automate the regular updating/verifying of this data by manually logging in with a dongle to their bank's website and manually downloading a CSV file, etc.?

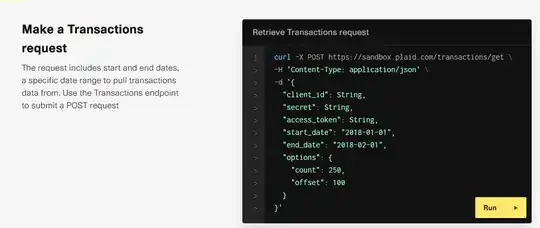

OR do you have access to some sort of nice API after all? Every time I've asked them about this, I've either been ignored or they have implied that it's only available for large corporations and/or authorities, and nothing that I can ever get (or afford!) as as an individual. I assume that really rich people have access to this. I'm unsure if those "personal finance" software packages still work, and if so, what kind of API/interface they are using.

(They actually have an entire dedicated website called something like "Open API", but it's a lie. It turns out that it's not actually an "open API" whatsoever, and it's just for the big companies/authorities. This is not said upfront anywhere, and only became apparent after I had spent countless hours trying to decipher it.)